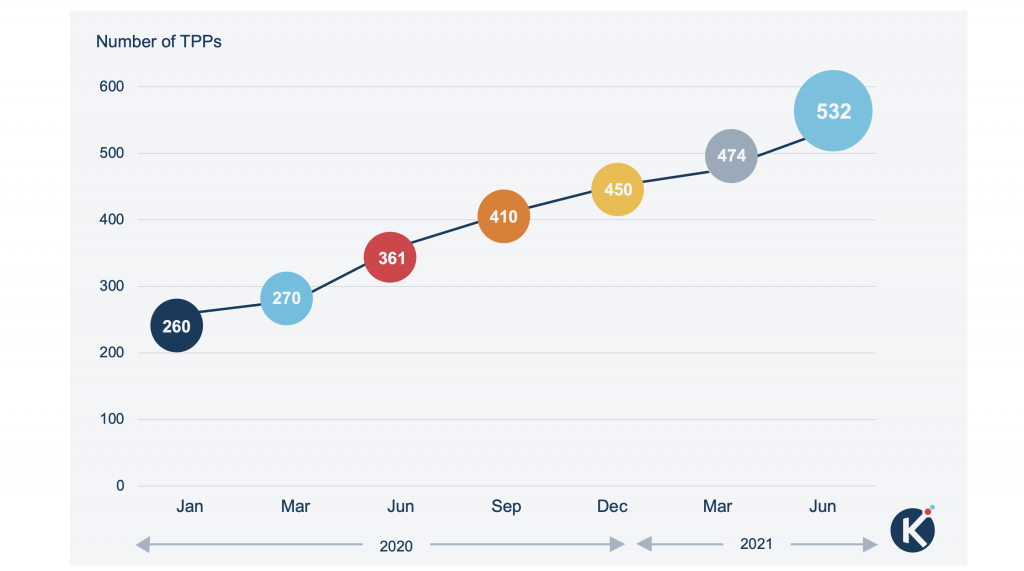

Although the total number of TPPs approved to provide services has only risen by 5% this quarter, the pattern is similar to the start of 2020. If we continue to follow last year’s curve, we can expect to see increased activity next quarter. In Q2 2020, there were 82 new TPPs approved, a 29% increase. We will be tracking the market closely to see whether this period of accelerated growth happens again this year!

Despite reporting an increase of 24 TPPs, there were in fact 26 new TPPs approved over the course of the quarter but, separately, 2 TPPs lost their regulated status – one in the UK and another in Denmark which brings our total figure to 474.

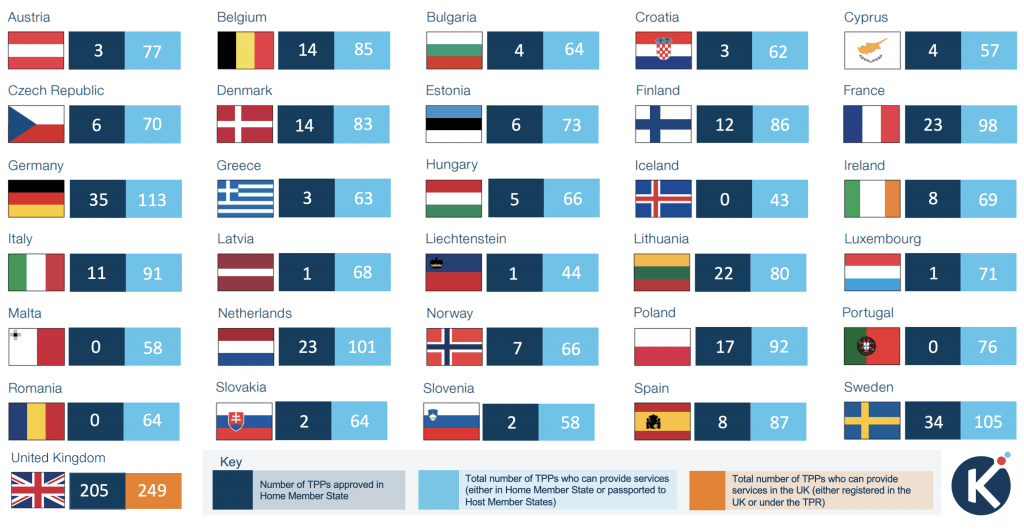

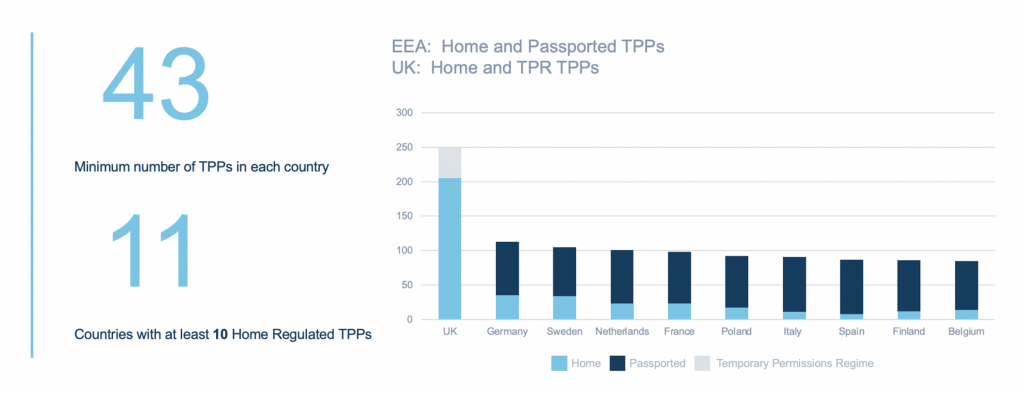

As expected, following the end of the Brexit transition period, there was a sharp decline in passported numbers for each country. At the end of 2020, every country in the EEA had at least 75 TPPs who could provide open banking. This number has now fallen to 43. However, despite this drop, data flowing through the Konsentus Verify platform shows that cross border transactions account for circa 30% of all open banking API calls.

Q1 Highlights

- 24 new TPPs approved to provide services across the EEA and UK

- Countries with over 100 TPPs (Home and Passported or registered under TPR): UK (249) Germany (113), Netherlands (101) and Sweden (105)

- Each country has at least 43 TPPs approved to provide open banking services. This was 75 at the end of Q4

- Poland has seen the largest increase this quarter at 42% with 5 new Home registered TPPs, taking its total to 17

- The Nordics have 3 countries in the top 10. Sweden (34), Denmark (14), Finland (12)

- There were 11 countries with newly regulated Home TPPs this quarter. These are: Belgium (1), Denmark (1), Estonia (1), Greece (1), Italy (2), Lithuania (1), Netherlands (3), Norway (1), Poland (5), Sweden (3), UK (5)

- 44 TPPs from the EEA can operate in the UK under the FCA’s Temporary Permissions Regime (TPR)

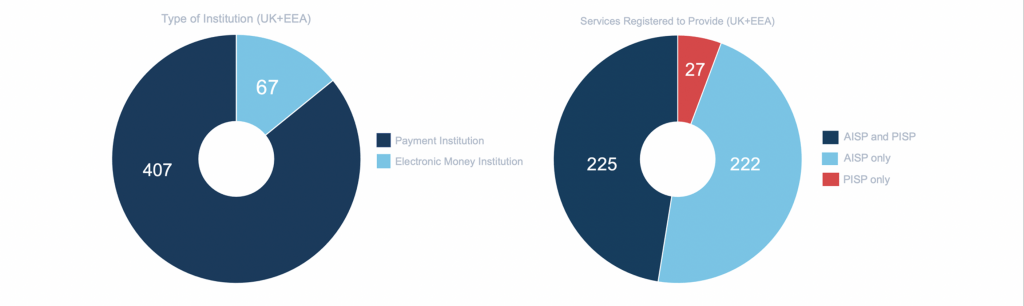

There is little movement on the percentage breakdown of services the TPPs are being authorised to provide. At the end of March 2021, 53% of all TPPs were registered to provide PISP services, whether that be standalone or in conjunction with AISP services.

When it comes to the types of institutions registering to operate as TPPs, there is again little change from last quarter. Electronic money institutions (EMIs) make up 14% of all TPPs. However, the proportion of EMIs is higher in the EEA (17%) than in the UK (10%).

Note: these figures do not include Credit Institutions acting as TPPs.

Forecasts for Q2

TPP growth over the first quarter of the year has been relatively slow however, if we follow historic trends, we anticipate that there will be 532 TPPs by the end of June 2021.

API calls across the EEA and the UK

As a result of Brexit, TPPs regulated by the UK’s Financial Conduct Authority are no longer able to passport their services into the EEA.

This has impacted our forecast API volumes as the methodology is based on the total number of TPPs in each country.

By the end of June 2021, Spain, France, Italy and Germany are all forecast to be experiencing monthly API volumes well over 50m and, the UK is still on target to reach in excess of 1bn.

Finland and Greece are also likely to be experiencing increasing volumes, reaching in excess of 5m by the end of June 2021.

“Despite a fall in the number of newly regulated TPPs and the decline in passporting numbers, we believe that the demand for open banking services is intensifying. Conversations we’re having with stakeholders in the wider ecosystem confirm that the market is taking off. What we’re also seeing through the Konsentus Verify platform is that there is strong demand for services from passported TPPs – these cross-border transaction requests account for approximately 30% of our overall volume each month.”

Mike Woods, CEO Konsentus