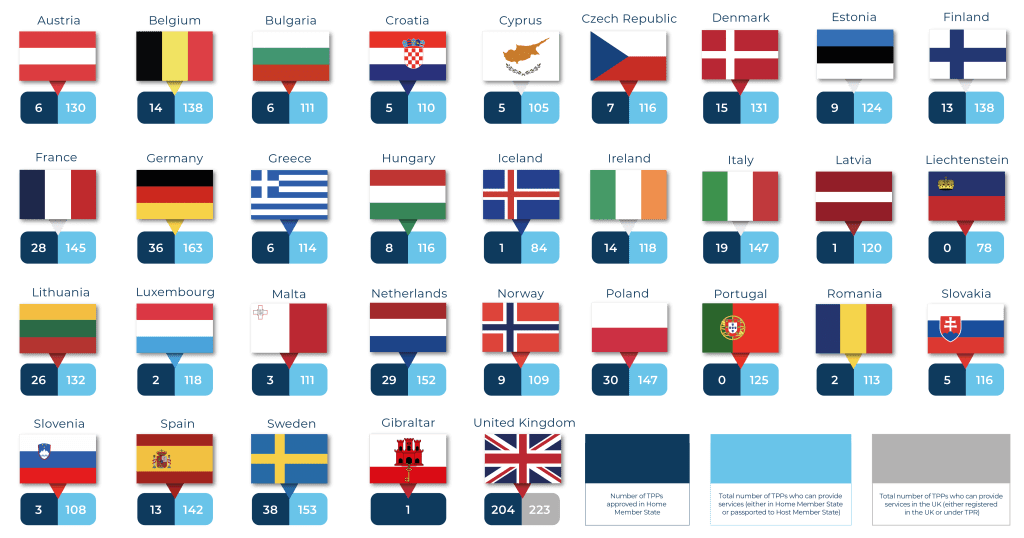

The number of TPPs that gained regulatory approval in the EEA in Q4 2022 mirrored the preceding three months. 11 TPPs were approved to provide Open Banking services during the last quarter of 2022. When this number is combined with the 4 TPPs whose authorisation status was removed, there is a net total gain of 7, taking the total for the EEA to 353.

In the UK, only 1 TPP gained regulatory approval during the last three months of the year, whereas 9 TPPs had their permissions removed. This reduces the figure for the UK and Gibraltar by 8 – down from 213 to 205.

The overall total, for the EEA and UK combined, now stands at 558, one less than the number reported at the end of September 2022.

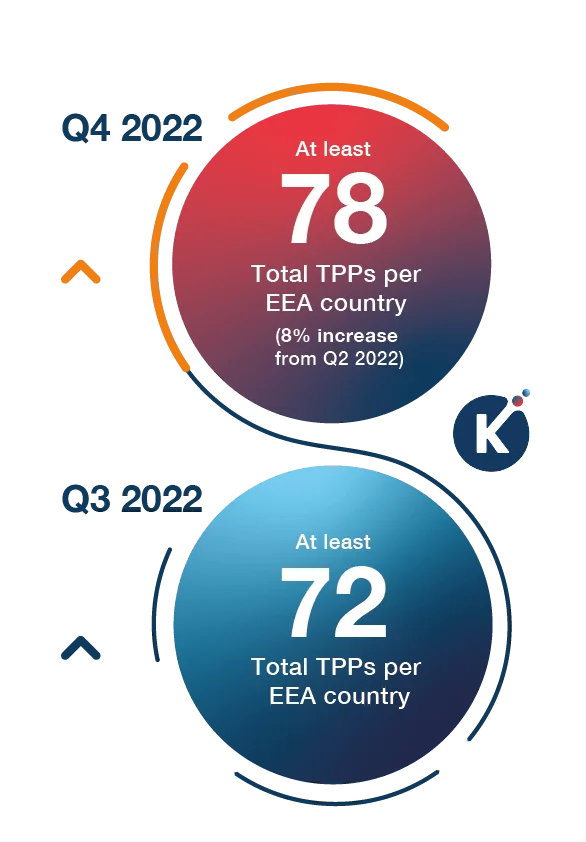

Despite the total number of Home regulated TPPs remaining static, once again there has been a rise in passporting. Existing TPPs, regulated in the EEA, are extending their permissions into new markets to grow their businesses. So, it’s essential now, more than ever, to ensure a real-time understanding of the permissions a TPP holds and the markets it can operate in. What may be true one month, may not be the next!

TPP Tracker Country Breakdown

Q4 Highlights

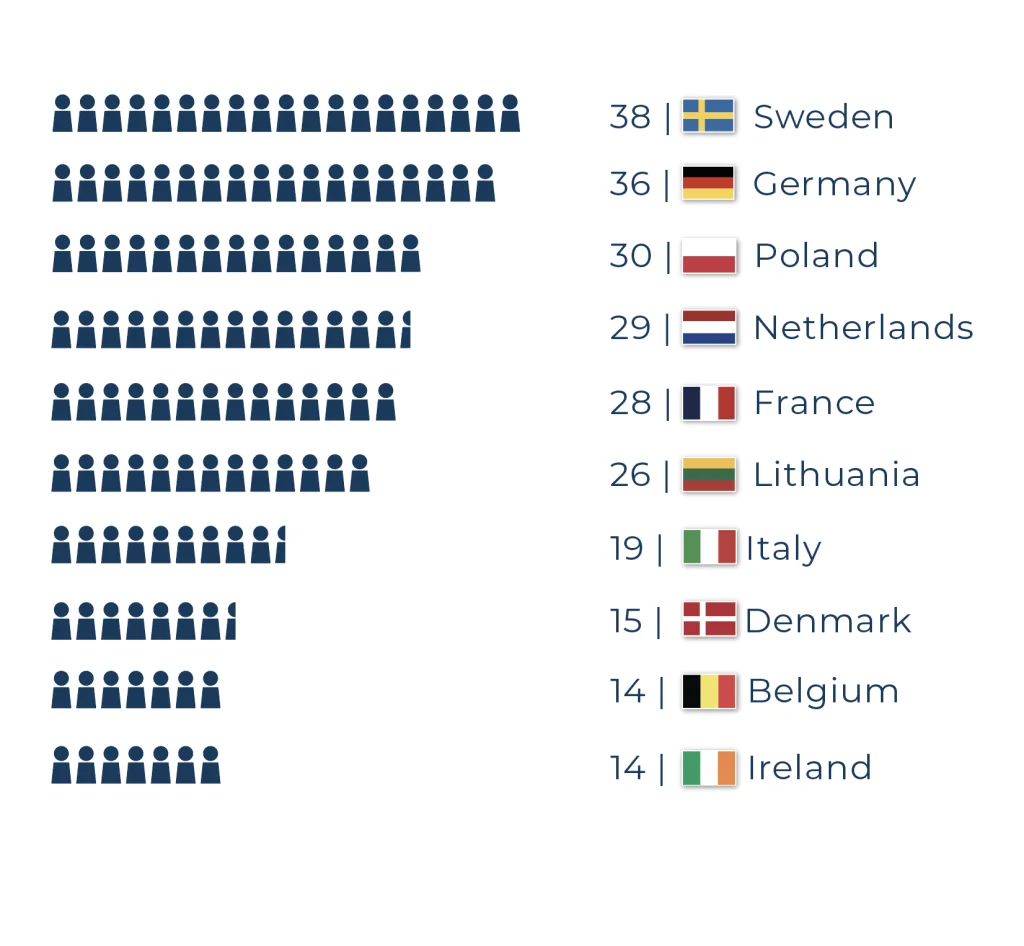

- Sweden once again has the highest number of Home TPPs. An additional newly regulated TPP takes its total to 38.

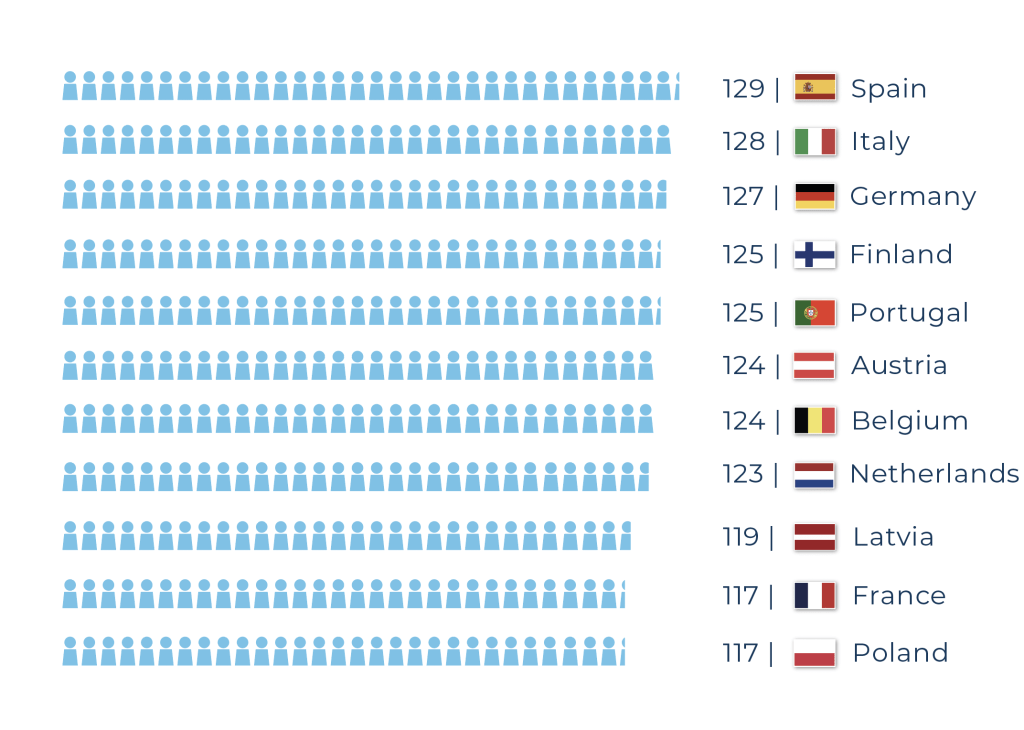

- Spain continues to have the highest number of Passported-In TPPs (129), but Italy and Germany follow close behind with 128 and 127 respectively.

- 9 countries gained TPPs this quarter: Denmark (1), Ireland (1), Italy (1), Lithuania (1), Netherlands (1), Norway (1), Poland (2), Slovakia (1), Sweden (2).

- TPPs from 4 countries had their permissions removed: Denmark (1) Ireland (1), Netherlands (1), Sweden (1).

- Poland had the highest increase in Home TPPs this quarter taking its total from 28 to 30, ranking it 3rd overall.

- Passported-in TPPs increased by 9 in 3 countries: Croatia, Romania and Slovakia.

Rise in Passported-in TPPs

Q4 2022.

Q3 2022.

Q2 2022.

Q1 2022.

Total Number of TPPs

TPPs passport within the EEA

(of the 353 total number)

total number

of TPPs

(per EEA country on average)

increase in

passported-in TPPs

(Dec ‘21 to Dec ‘22)

more Passported-in TPPs

(per EEA country on average)

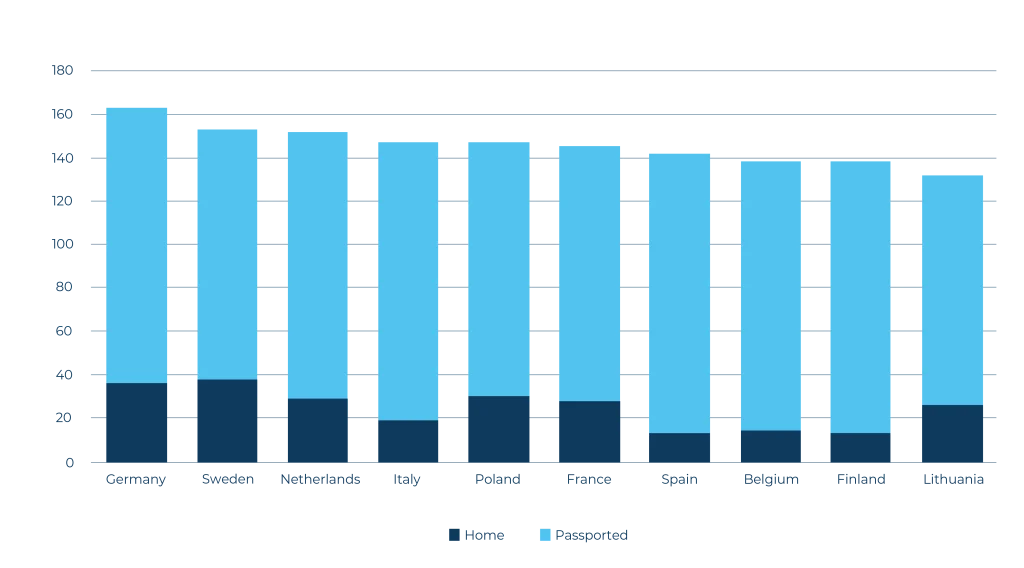

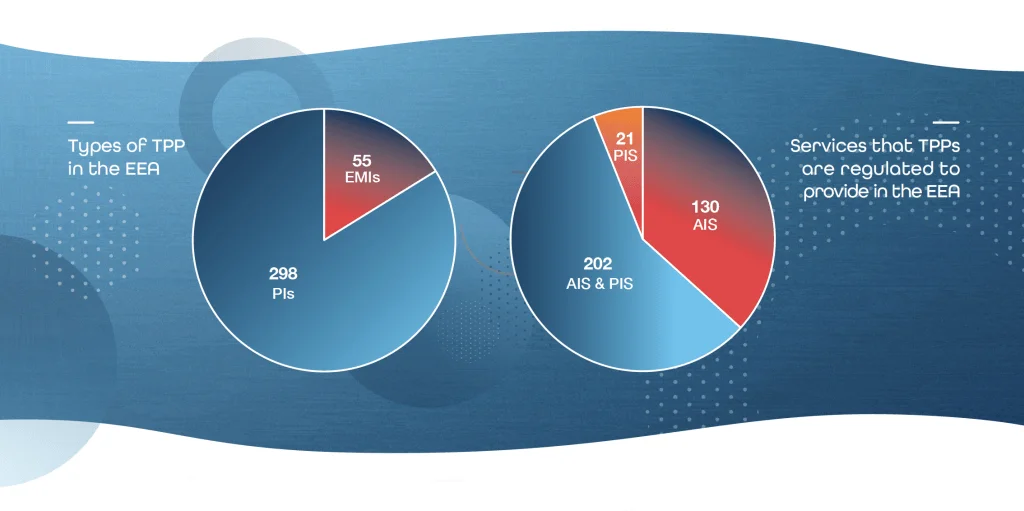

Of the 353 fintech TPPs regulated in the EEA, exactly half of them passport open banking services into countries outside their Home regulated market.

Despite this number remaining static over recent quarters, the average number of passported-in TPPs in each country has risen significantly over the past year.

There has been an increase of 30% (from 86 to 112) in the average number of passported-in TPPs per EEA market since December 2021. This means that TPPs already regulated in some markets are continuing to extend their geographical reach to grow their businesses.

Total 10 Countries by TPPs

Home Registered TPPs

Passported TPPs

Key Changes

Reflections from Our CEO

"Comparing the data at the end of 2022 with the numbers we reported at the end of 2021 enables me to see how the ecosystem has changed. It now doesn’t matter how many Home regulated TPPs have been authorised in any given market, as public demand for innovative products and services can be successfully met by the multitude of TPPs passporting in their services from elsewhere.

Take for example Portugal – despite there being no TPPs regulated by the Banco de Portugal - there is a thriving fintech community servicing both consumer and business users alike. And, in fact, Portugual now has the fifth highest number of Passported-In TPPs – only four fewer than Spain which has the highest overall number.

The typical data supply chain is often no longer limited to a single market so, it’s vital that systems and processes keep pace with these changes and continue to protect end-user data and funds upholding trust and confidence in the wider ecosystem."

Mike Woods, CEO Konsentus