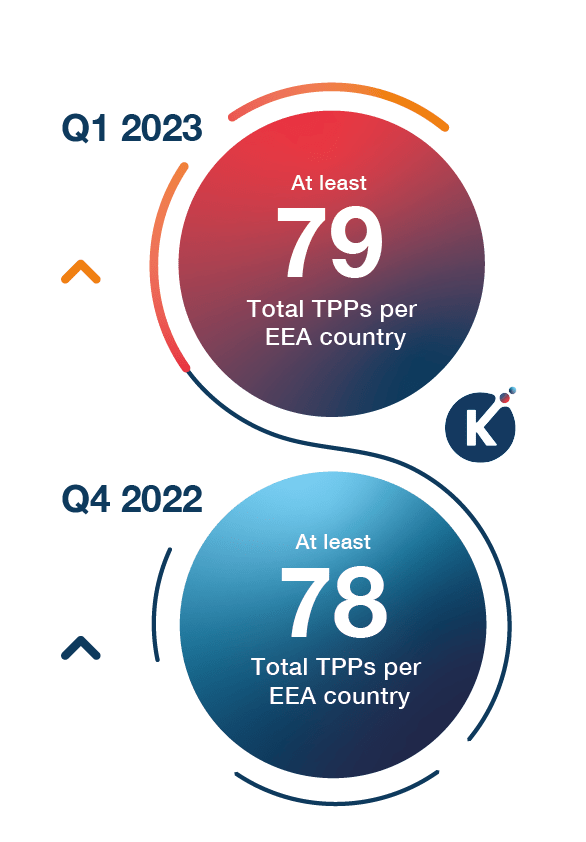

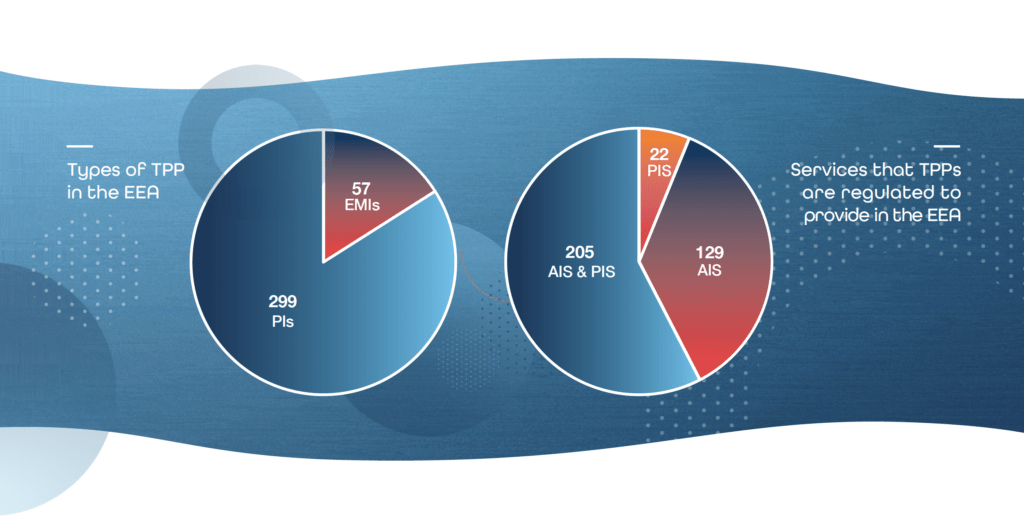

With the European open banking market maturing, we are seeing a slowdown in the overall growth of newly regulated TPPs. In 2020, the average quarterly growth in the EEA was 16%. In 2021 it had dropped to 6% and, last year, the quarterly growth averaged 3%. It is not surprising therefore that in the first quarter of 2023, this trend has continued and the total number of TPPs only increased by three, taking the total to 356, a growth rate of just under 1%.

In the UK, which has over 200 regulated TPPs, we’ve seen a slight decline in newly regulated entities since mid-2022 due to mergers and acquisitions alongside failed business models. The number of regulated TPPs in the UK (including one in Gibraltar) now stands at 203, two less than at the end of 2022. This brings the overall number of TPPs in the EEA & the UK to 559, one more than at the end of 2022.

Despite the slowdown in overall net growth, there is still plenty of activity at a market level. During Q1 2023, 8 new entities from across the EEA and the UK gained regulatory approval to provide open banking services and 7 TPPs lost their permissions. And, as we have seen in previous quarters, passported growth continues with 7 countries gaining 3 or more Passported-In TPPs.

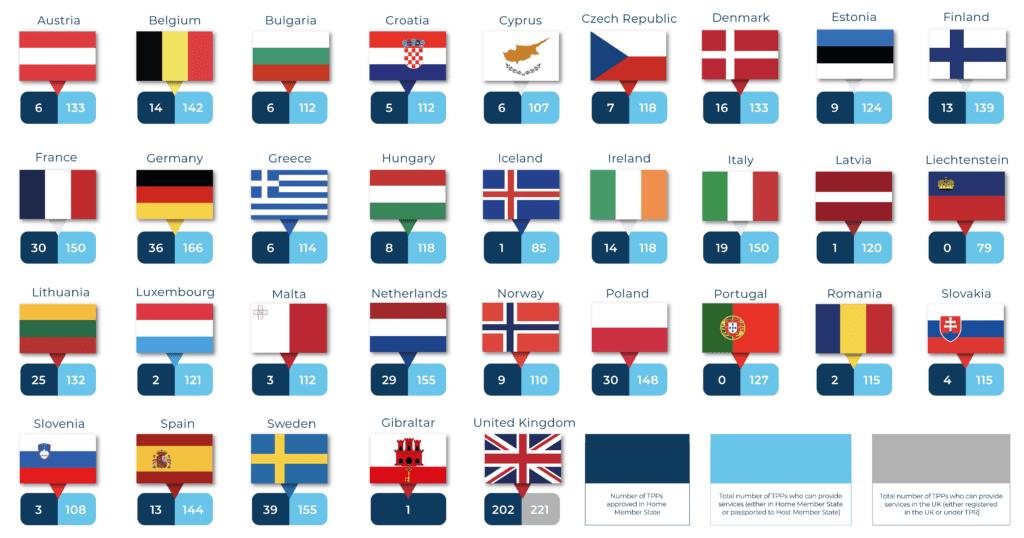

TPP Tracker Country Breakdown

Q1 Highlights

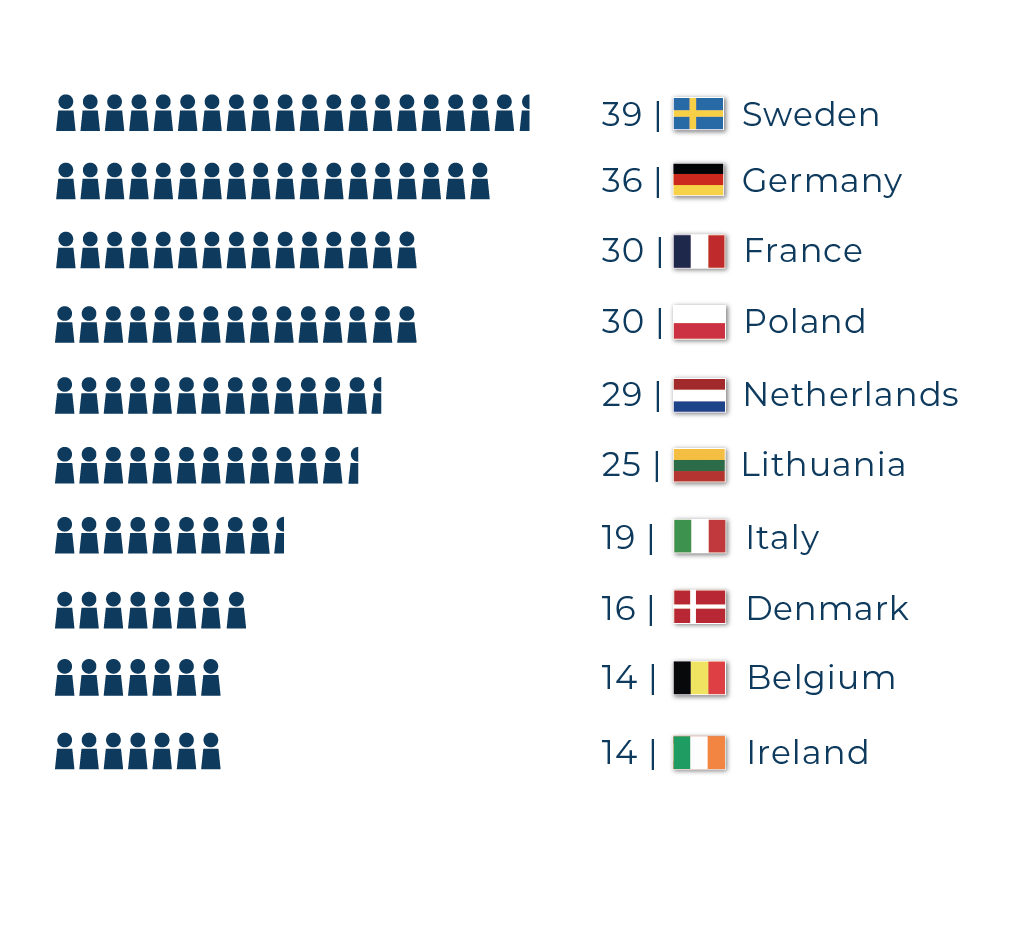

- Sweden once again has the highest number of Home TPPs (39), increasing its lead over Germany.

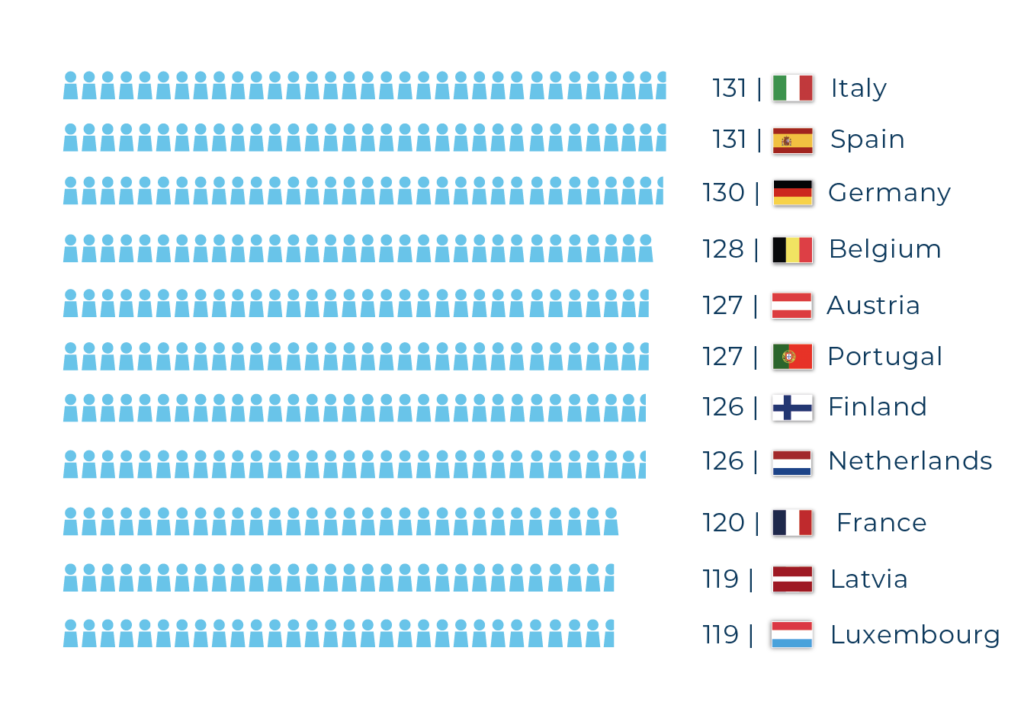

- Italy and Spain are joint highest by Passported-In TPPs (131), followed closely by Germany (130).

- TPPs from Belgium (1), Cyprus (1), Denmark (1), France (2) and Sweden (2) gained regulatory approval during Q1 2023.

- TPPs from 4 countries had their permissions removed: Belgium (1), Lithuania (1), Slovakia (1) and Sweden (1).

- France had the highest increase in Home TPPs this quarter taking its total from 28 to 30, ranking it 3rd alongside Poland.

- Passported-In TPPs increased by 4 in Belgium and a further 6 countries gained 3 passported TPPs (Austria, France, Germany, Italy, Luxembourg and the Netherlands)

Number of Countries with More Than 100 Passported-In TPPs

Q1 2023.

Q4 2022.

Q3 2022.

Q2 2022.

Total Number of TPPs

TPPs passport within

the EEA

(of the 356 total number)

total number

of TPPs

(per EEA country on average)

increase in

passported-in TPPs

(Mar ‘22 to Mar ‘23)

Countries with <100

Total TPPs

(per EEA country on average)

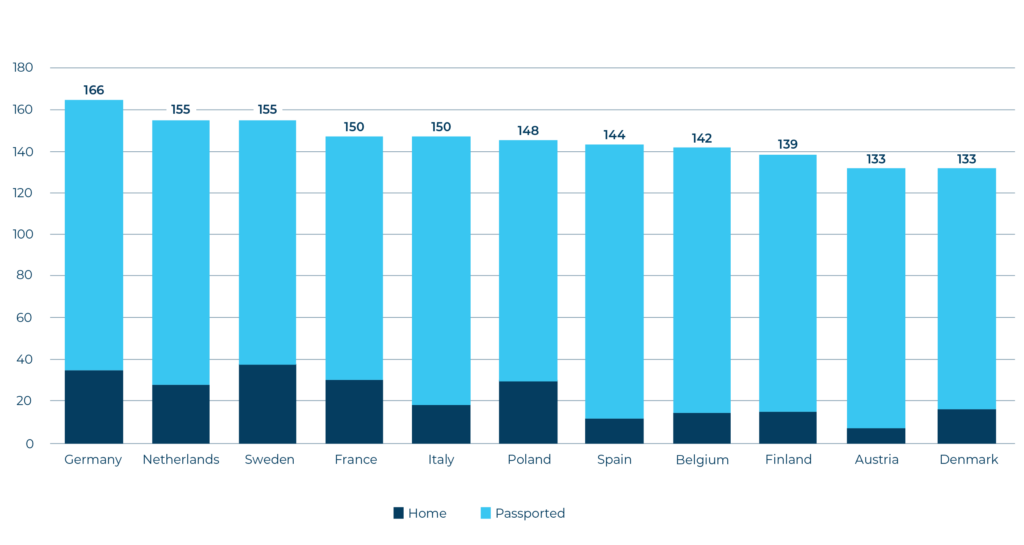

The proportion of TPPs passporting their Open Banking services into other EEA markets remains largely unchanged at just under 50% of the total.

There has been an increase of 23% (from 93 to 114) in the average number of Passported-In TPPs per EEA market since March 2022. This is slightly lower than the yearly increase reported last quarter (30%), demonstrating maturity and consolidation in the market.

Iceland and Liechtenstein remain the only two countries in the EEA with less than 100 Passported-In TPPs, this is unchanged from the end of Q4 2022. But when comparing the data with this time last year, a marked difference can be seen. At the end of March 2022, two-thirds of all EEA markets had less than 100 Passported-In TPPs.

Top 10 Countries

Home Registered TPPs

Passported TPPs

Key Changes

Reflections from Our CEO

"We are now in the fifth year of open banking under PSD2 and are starting to see the market settling down.

The first two or three years of high growth have been followed by a period of consolidation and change resulting in a slowdown in overall net growth. But banks should not be complacent – there is still plenty of change at an individual market level which makes security and trust in the ecosystem as relevant today as it was five years ago.

Certificates expire and entities change the services they provide and the markets they do business in. That’s why it’s always important to check the permissions a TPP holds each time a transaction request is made. And, of course, that’s where our expertise lies and why financial institutions trust us to keep the ecosystem running smoothly."Mike Woods, CEO Konsentus