Open Banking Enabled Services are the services offered to End Users which rely fully or partially on Open Banking.

Open Banking Exchange Europe has been surveying the market to find out what Open Banking Enabled Services are now being offered to consumers and businesses. This article describes the services that we have identified so far and the TPPs that are offering them.

Open Banking is a game changer and its impacts are not limited to the banking industry. If you are an industry insider and hear “services 7 and 8 of PSD2”, you will understand “Payment Initiation” and “Account Information”. But if you’re an outsider to the industry, you will be left wondering, so what? What does that mean in the real world? How can I benefit from Open Banking?

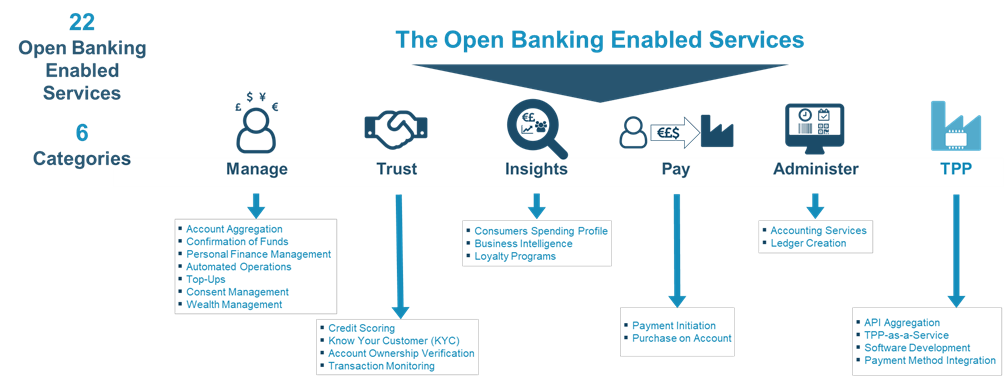

Open Banking Exchange Europe has tried to answer these questions by defining the Open Banking Enabled Services currently being offered. We studied over 280 TPPs in the EEA and the UK and have defined 22 Open Banking Enabled Services, divided into 6 categories.

What is an Open Banking Enabled Service?

The legislation that lays the groundwork for Open Banking defines the payment services that the authorised entities can provide between each other. Open Banking Enabled Services are the services offered to End Users which rely fully or partially on Open Banking. End Users might be consumers, SME’s, corporates, merchants, businesses, utilities, government agencies.

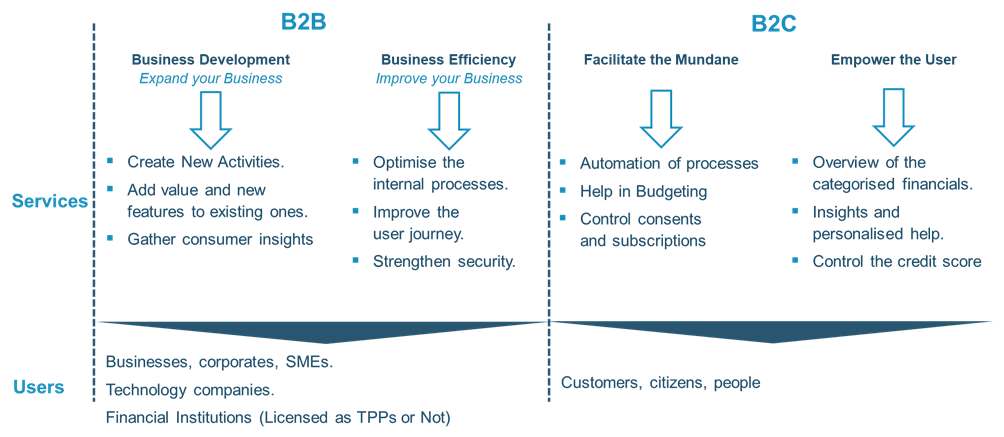

Open Banking Enabled Services can provide valuable tools to business managers, as they help to Increase Revenue (Expand your Business) or Decrease Expenses (Business Efficiency). On the one hand, Open Banking lets businesses expand by allowing them to offer new products/services, add new features to existing offers, or gather more consumer insights. On the other hand, a business can resort to Open Banking to optimise internal processes, improve the customer journey, and strengthen its security.

Open Banking can also improve everyday life, as it facilitates mundane tasks, or it can empower users to make wiser financial decisions.

The Open Banking Enabled Services

Having defined Open Banking Enabled Services and the reasons to use Open Banking, it is now easier to understand the services proposed by OBE. We have defined 22 Services distributed between 6 Categories, as shown below.

Open Banking Enabled Services that fall in the Manage category provide the user with more control over their finances. They include services that empower the users by giving them aggregated or categorised information or allowing them to automate or execute tasks or reach their goals.

Open Banking Enabled Services that fall in the Trust category offer user identification and analysis through financial data. Firms need Open Banking Enabled Trust services for various reasons depending on the business, whether meeting compliance obligations, reducing risk, or providing a better service to customers by reducing frictions.

Open Banking Enabled Services that fall in the Insights category use the financial data gathered from the ASPSP APIs and transform it to provide valuable information. The data may be used to analyse consumer behaviours and to customise offers for them, or to study the optimal use of the company’s resources.

Open Banking Enabled Services that fall in the Administer category use data gathered from the ASPSP APIs to help the user to optimise or meet their reporting requirements.

Open Banking Enabled Services that fall in the Pay category allow users to pay each other from their bank account. Payment Initiation Services may be combined with Account Information Services to give additional trust or information to one party or another.

Open Banking Enabled Services that fall in the TPP category allow the users to capitalise on Open Banking. The services in this category vary from helping TPPs to enter the market to allowing firms to add value to their offers to end consumers.

What Types of TPPs Provide the Services?

We have identified three types of providers based on the target audience of their services. The first type includes the institutions that use Open Banking Enabled Services as support to their main activities. The second type are TPPs that provide software for businesses in the form of white label software or SaaS that the buyer can commercialise or programs that help the firm’s activities. Finally, there are the TPPs that offer services to the end consumers through APPs or other platforms. The boundaries between these types are flexible, and through brand and different commercial identities, a TPP can provide multiple services.

Metrics

In our analysis, we have also created metrics that give us more information on the current market situation. The analysis is limited to the TPPs that we analysed (over 280), so it is not a complete market report, but we consider the sample to be substantial enough to allow us to offer the analysis below.

The Top 5 Services Offered

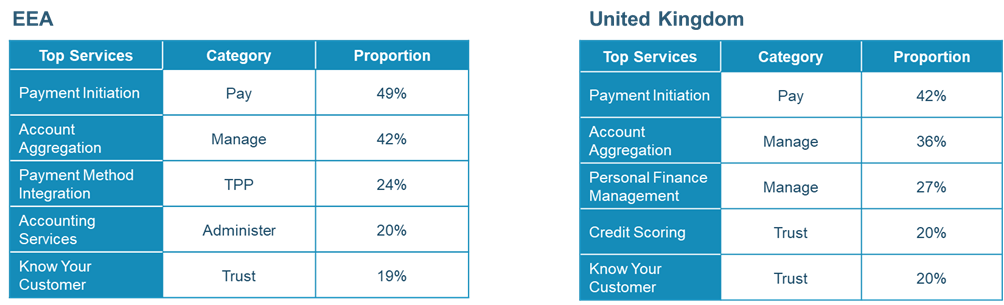

As to the Top 5 services offered, both “Payment Initiation” and “Account Aggregation” lead the list, with slightly different percentages. Regarding the remaining places, “Know Your Customer (KYC)” is common in both (in the fifth position), but the remaining two services for each market do not appear in the other’s Top 5.

Services Distribution

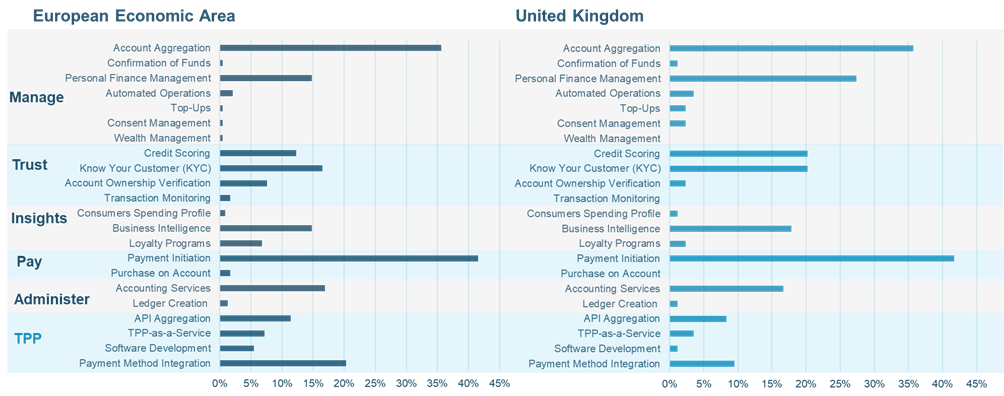

If we take a more detailed look at the distribution by service, we can notice that there are three services offered in the EEA that are not offered by the UK TPPs that we analysed – “Wealth Management”, “Transaction Monitoring”, and “Purchase on Account”. Furthermore, we can see that services such as “Top-Ups” and “Consent Management” have more significance in the UK.

Open Banking Enabled Services by User Segment

As to the User Segments of the services provided, we can see a significant difference between the UK and the EEA. The User Segment division in the UK is more evenly spread than in the EEA, with the B2B and B2B / B2C categories sharing the lead. In both markets, the B2C category is the least common. In the EEA, the B2B / B2C category represents over half the market.

Number of Categories Provided by Any Given TPP

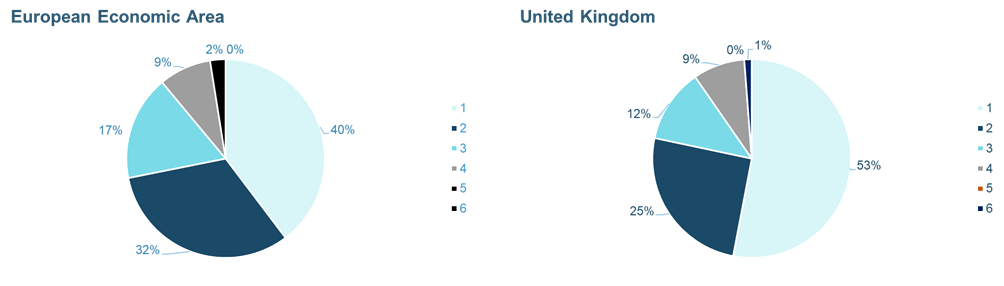

The charts above show the number of categories that any given TPP is providing. When comparing both markets, the share of entities that only provide services in a single category in the UK stands out. Given that the UK market is more mature than the EEA market, this may be an indication that more TPPs are specialising in the UK.

We have also concluded that when TPPs only provide services for a single category, the most common category is “Manage”. This may be because the Manage category is one of the easiest to start with, based on the mandatory APIs and in the existing offer for plug-in software.

Conclusion

We are at the beginning of the Open Banking journey but services are proliferating. Already we are seeing innovative use cases for a wide range of applications. By monitoring and tracking what is in the market, we can provide a baseline for the evolution of European Open Banking over time, and then start looking beyond into Open Finance and into other countries.