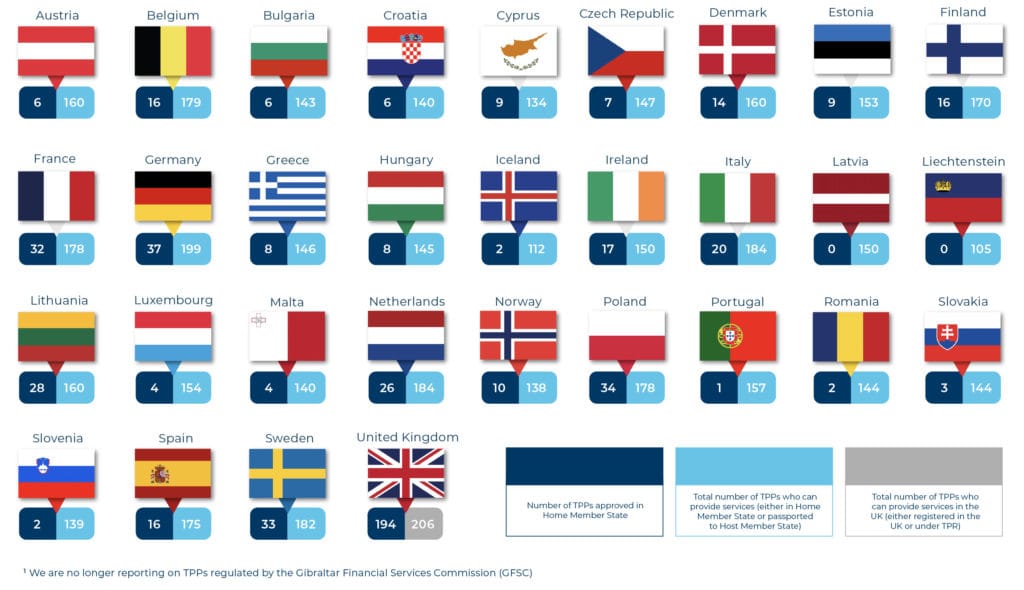

As we progress through 2024, the open banking ecosystem continues to shift across both the European Economic Area (EEA) and the United Kingdom (UK). The total number of registered Third Party Providers (TPPs) now stands at 570, comprising 376 in the EEA and 194 in the UK.

This quarter, the EEA has seen a net increase of 6 TPPs, continuing its upward trend, whereas the UK has experienced a slight decline, with a net reduction of 3 TPPs compared to the previous quarter.

Regulatory permission changes remain a key indicator of market activity. In Q3, 25 TPPs underwent permission changes, with 14 gaining new open banking regulatory permissions and 11 having their permissions removed, leading to a net increase of 3 TPPs holding active regulatory approval.

These changes highlight the evolving regulatory landscape and the importance of maintaining accurate oversight of TPP activity. As the market matures, financial institutions must stay informed of these developments to ensure compliance and maintain confidence in their open banking activities.

Q3 Highlights (EEA)

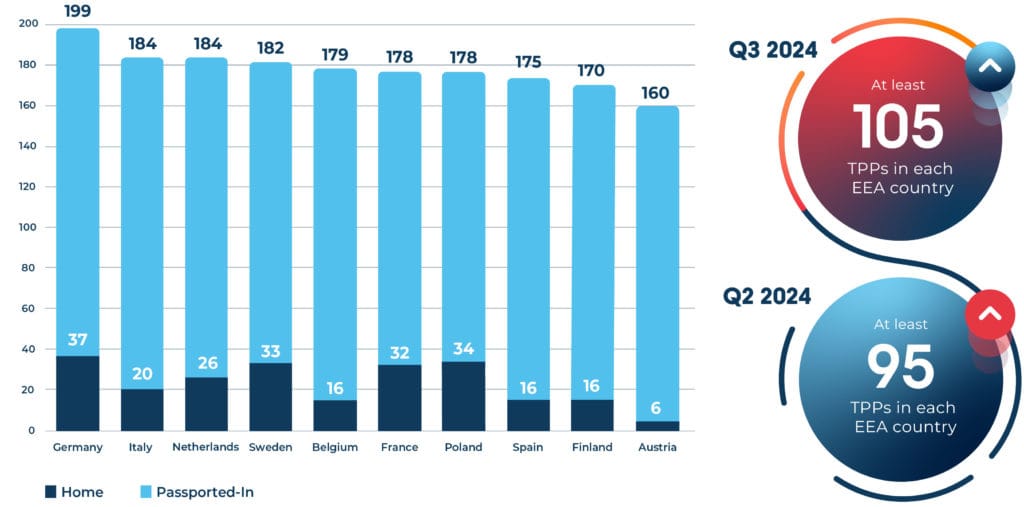

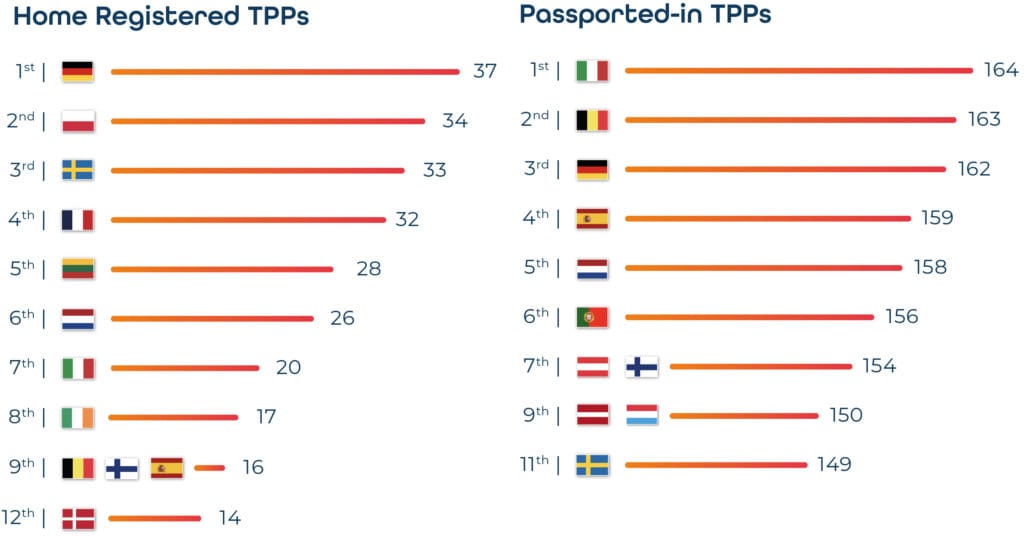

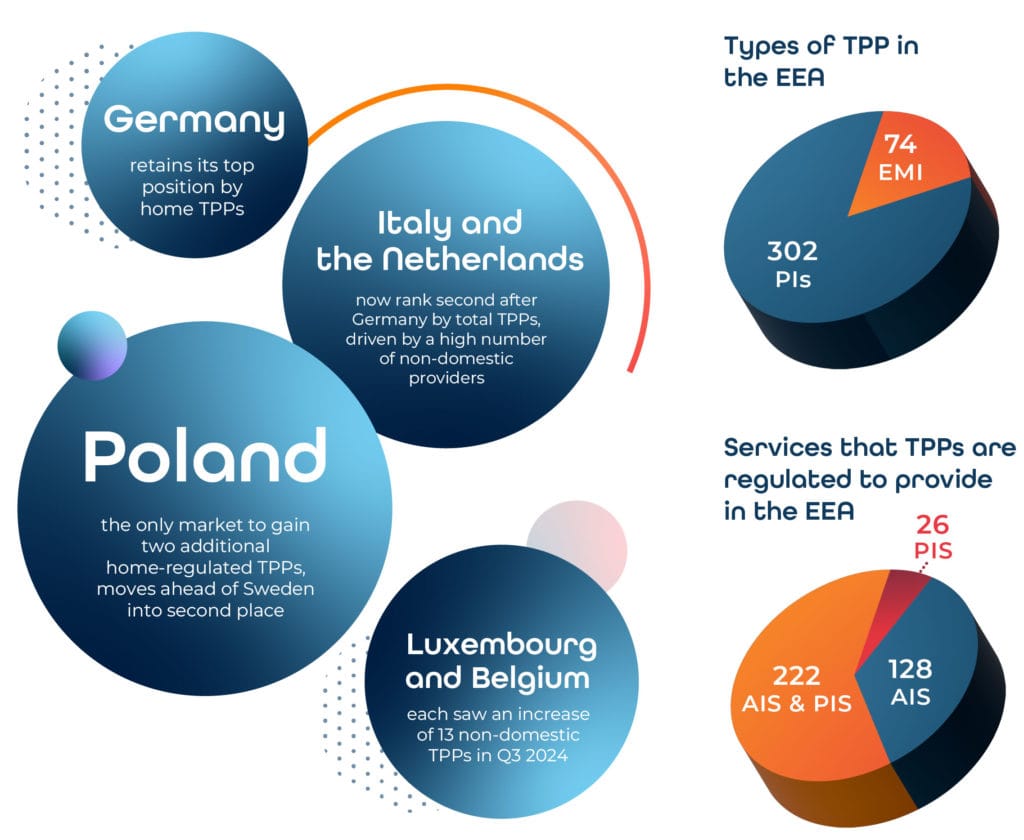

- Germany retains its position as the top EEA market by home-regulated TPPs, maintaining a total of 37. Poland has now moved into second place with 34.

- Italy and the Netherlands continues to lead in non-domestic TPPs, with 164 passporting their services into the market. However, Belgium is close behind, with 163 non-domestic TPPs.

- Regulatory approvals were granted to TPPs from 10 different EEA countries in Q3 2024, comprising: Poland (2), Cyprus, France, Greece, Ireland, Italy, Lithuania, Malta, Netherlands and Spain (each with 1 new TPP).

- Five EEA markets saw TPPs have their open banking permissions removed, affecting: France, Lithuania, Netherlands, Spain and Sweden (each losing 1 TPP).

- Latvia and Liechtenstein once again remain the only two EEA countries without home-regulated TPPs, though each has over 105 non-domestic TPPs authorised to provide open banking services into the market.

- Passporting activity has seen a notable increase, with each EEA market adding an average of 10 new non-domestic TPPs in the past quarter.

Year on Year Rise in Passported-In TPPs

Average per EEA Country

Top 10 EEA markets by total number of TPPs

TPPs (56%) passport their open banking services outside their domestic market

Average total number of TPPs per EEA country

Average of TPPs operating in each EEA market are regulated by a Competent Authority from another country

average increase per country by total TPPs over the last quarter (Jun 24 to Sept 24)

For the first time since the tracker’s launch, all 30 EEA markets now have more than 100 regulated fintech TPPs providing open banking services. This milestone highlights the continued expansion of passporting across the region, ensuring that even markets with few domestically regulated TPPs benefit from a broad range of fintech providers offering innovative financial services.

This quarter, we’ve observed an average increase of 10 TPPs per EEA market, driven by organisations expanding their services into new territories. As passporting activity accelerates, staying up to date with regulatory permissions is more important than ever. What holds true one month may shift the next, as TPPs can modify their permissions at any time. The regulatory landscape is constantly evolving, reinforcing the need for ongoing monitoring to maintain compliance and ensure trust in open banking transactions.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

The open banking ecosystem continues to expand, with the number of EEA-regulated TPPs more than tripling in the past five years - rising from 118 in September 2019 to 376 in September 2024.

As more fintechs enter the market and extend their reach across multiple jurisdictions, the complexity of tracking and verifying regulatory permissions grows.

This quarter, we’ve seen further increases in both payment initiation capabilities and passporting activity, reinforcing the need for financial institutions to maintain real-time oversight of who is accessing their customers’ data and funds. In a rapidly evolving landscape, ensuring trust and compliance remains paramount."Mike Woods, CEO Konsentus