Powered by Latam Fintech Hub, Open Finance Market (Bogota, 5 May) brought together business leaders and creators to discuss the most important trends in open finance in Latin America. This year, the focus was on the many ways in which financial institutions and Fintechs can continue to accelerate financial inclusion in times of change.

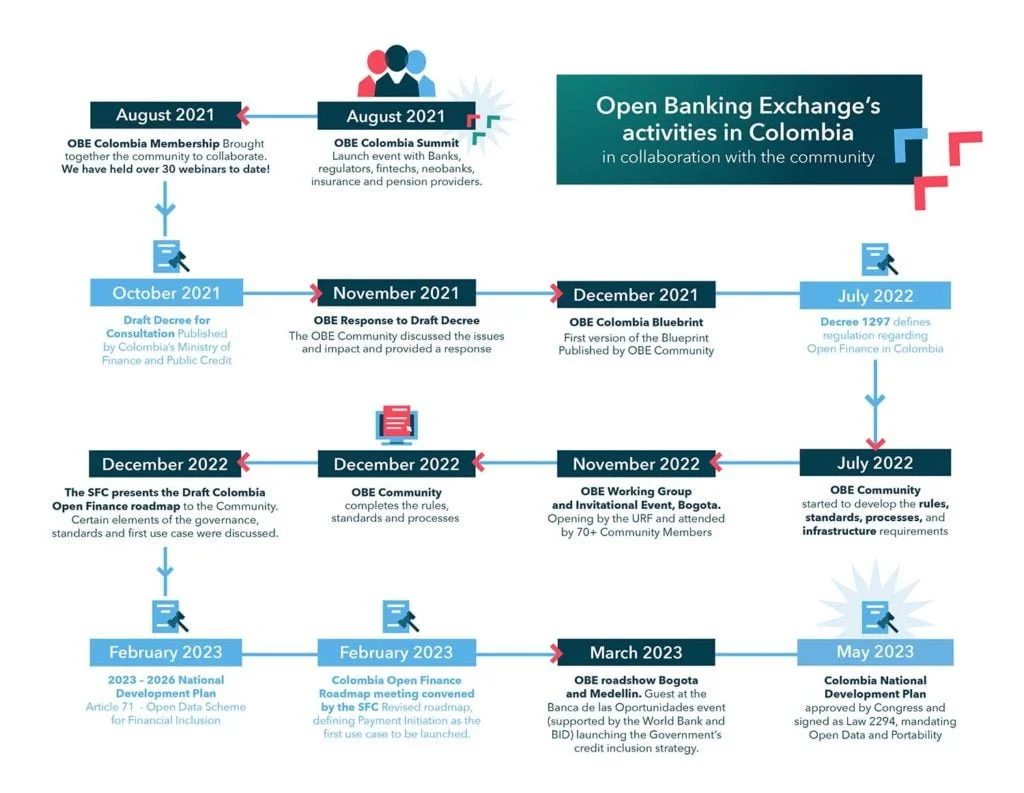

John Broxis, Managing Director Open Banking Exchange*, gave an insight into how OBE has been collaborating and working with the open banking community in Colombia over the last 2 years, and what it will take to move from concept to reality.

Some of these thoughts are captured in his post-event blog below!

Blog: Open Banking in Colombia

9 May 2023

John Broxis, MD, Open Banking Exchange

It is rare that I go to Colombia twice in six weeks! But recently I’ve been to the Foro de Inclusión e Innovación Crediticia para la Economía Popular, held by Banca de las Oportunidades and then, last week, to Open Finance Market 2023, organised by our associates, Latam Fintech hub.

At Open Finance Market, I was invited to provide insights gathered from our two-year programme with the Colombian market in a panel entitled “Shifting Gears: Moving Open Banking in Colombia from Concept to Reality”.

We have been working with Colombian banks and FinTechs through our membership programme to develop principles, frameworks and standards that promote safe and easy access alongside adoption whilst also allowing interoperability.

These conferences are important as they allow Colombian banks, FinTechs and other financial service providers, as well as regulators, to come together to understand the impact of multiple initiatives that are related to Open Banking, Open Finance and Open Data. In fact, via an informal survey I conducted while speaking to different delegates, understanding the complexity was seen as one of the priorities to enable an Open Finance ecosystem to be rolled out in the short term.

There are different workstreams that are being followed in parallel. Decree 1297 defined and allowed Open Finance as an optional service. Article 71 of the National Development Plan (what is now Article 89 in the approved version), made this mandatory. The government then embarked on an Open Data project – which will formally be launched on June 2nd, with first standards expected at the end of July. At the same time, the central bank is running two payment initiatives. It is easy therefore to see the challenges facing organisations working out what the changing landscape means for them!

The relationship between the different regulatory initiatives and the resulting “standards” that are being created, how they relate to each other and what they will and will not cover is complex to understand. There is also uncertainty about the relationship between Payment Initiation and Payments – both now and as the Colombian payment infrastructure is extended.

Some simple steps, as we articulated at the conference, can help those navigating these complex challenges:

- Learn from other countries’ mistakes, but don’t “Copy Paste” their solutions. Each country has different needs.

- Find objective advisors: neither the banks, nor the FinTechs can own the dialogue.

- Start quickly and fail fast! An iterative approach is needed. Brazil and the UK were both mentioned as countries with impressive rollouts, but also with flaws that need to be addressed.

- Speak together and use a common language. The word “standards” is not standardised, and there are regulatory standards, technical standards, operational standards and legal standards.

Clearly, the situation is developing fast and we see an increased scope of work but there are risks that must be carefully considered. We hope that the gains that have been made over the last two years can be consolidated and we look forward to the next chapter.

A brief summary of Open Banking Exchange’s activities in conjunction with the Colombian community

We would like to thank Edwin Zácipa and the team from Latam Fintech Hub for putting together such a great event and for the excellent speaker line up from across the ecosystem.

*Open Banking Exchange advisory and consultancy services are now being provided by Konsentus.