At first glance, Q1 2025 appears to signal continued consolidation in open banking, with the total number of regulated Third Party Providers (TPPs) across Europe falling to 551 – a net decrease of 17 from the end of 2024. The total comprises 356 TPPs in the European Economic Area (EEA) and 195 in the UK.

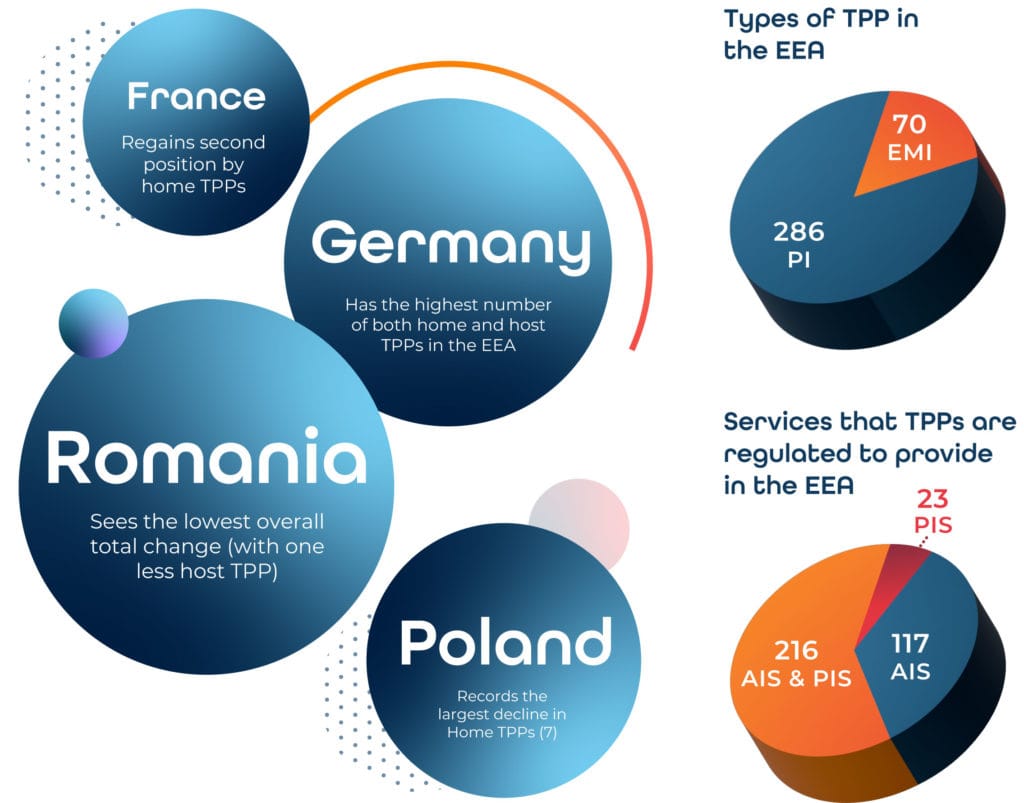

But beneath the surface, this was anything but a quiet quarter. In fact, we saw more market movement than in recent periods, with 31 regulatory permission changes – over 50% more than last quarter’s 20 – marking the highest level of change in some time. The EEA accounted for the largest share of this activity, with 24 of the 31 changes happening there, reflecting not just contraction but a reshaping of the ecosystem through exits, mergers and strategic repositioning.

This level of change underscores just how important it is for banks to perform real-time checks when receiving account access requests. As the market shifts, there’s an increasing risk that TPPs may present valid-looking eIDAS certificates despite no longer being authorised to operate – posing a serious trust and compliance risk if not caught.

It’s also worth remembering that our tracker focuses specifically on the fintech segment of the market. Beyond these 551 organisations, an estimated 4,000 to 5,000 credit institutions across Europe can also act as TPPs – and this larger group will be experiencing change as well. The true scale of movement is likely to be far greater than the numbers here suggest.

Q1 2025 Highlights (EEA)

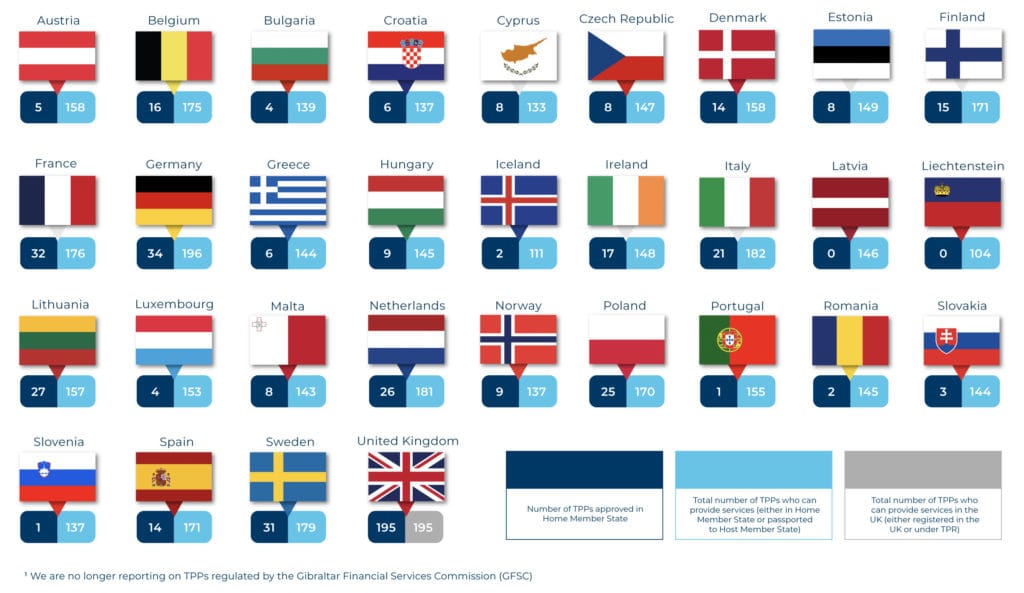

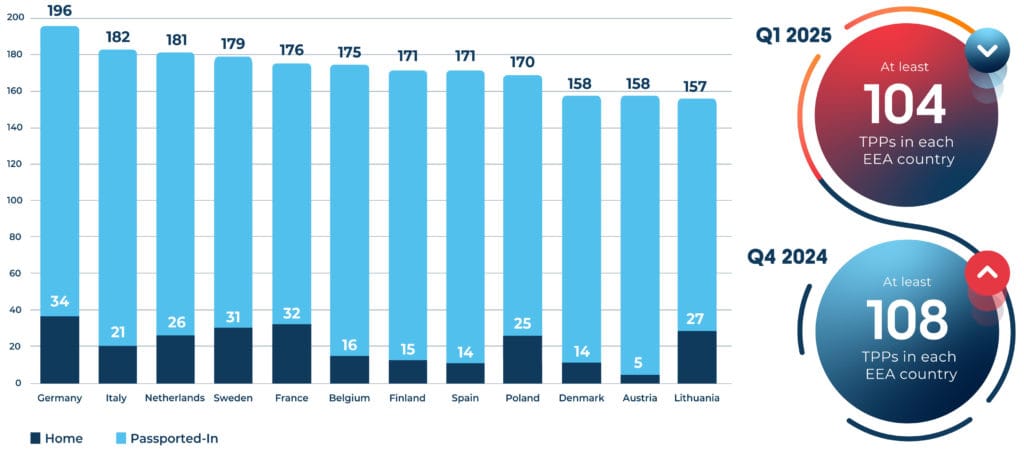

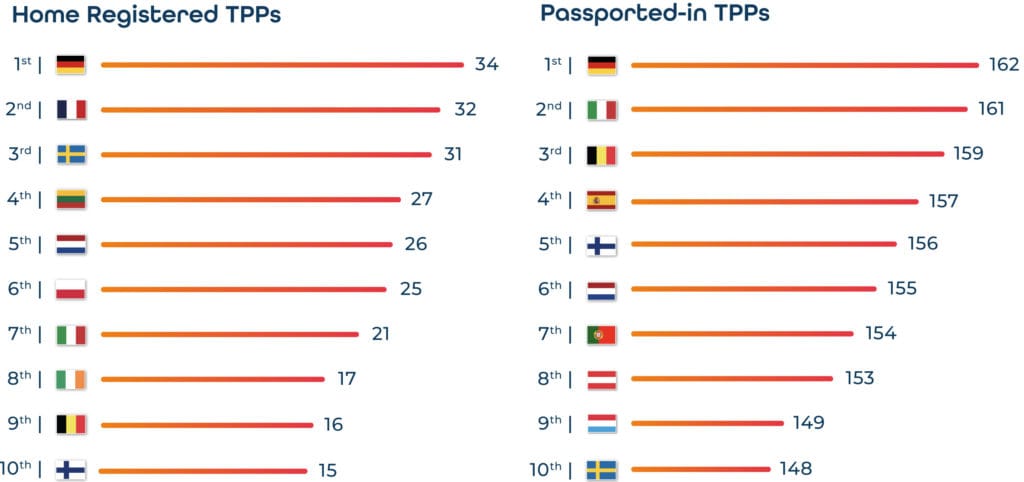

- Germany continues to have the highest number of home-regulated TPPs (34), despite one TPP losing its regulatory status. France follows with 32, and Sweden with 31.

- Germany also now leads passported-in TPPs with 162, a decrease of 2 since the end of Q4 2024. Italy follows closely with 161, and Belgium with 159.

- Regulatory approvals were granted to 4 TPPs across four EEA countries: Belgium (1), Czech Republic (1), Malta (1), and Spain (1).

- 20 TPPs across twelve EEA countries lost open banking permissions this quarter -double the number of countries affected compared to last quarter. These included: Austria (1), Belgium (1), Bulgaria (2), Cyprus (1), Estonia (1), Finland (1), Germany (1), Greece (2), Poland (7), Slovenia (1), Spain (1), and Sweden (1).

- Latvia and Liechtenstein remain the only EEA countries without any home-regulated TPPs. Both saw a reduction of 4 passported-in TPPs, the largest decline this quarter—matched by Croatia, Iceland, Malta, and Spain.

- Although the average number of non-domestic TPPs per EEA market has declined by 3 this quarter, the proportion of TPPs authorised to passport their open banking services to other markets has increased (from 56% to 58%) indicating stronger relative passporting activity.

- All EEA countries now have at least 104 TPPs approved to provide open banking services.

Increase in TPPs Passporting Services

Top EEA markets by total number of TPPs

TPPs (58%) in the EEA passport their open banking services outside their domestic market

Average total number of TPPs per EEA country

On average 92% of TPPs in each EEA market are regulated by an NCA from another country

Of EEA countries have over 150 authorised open banking TPPs

While overall TPP numbers saw a modest decline in Q1 2025, the reach of these providers continues to expand across borders. Today, 58% of EEA-regulated TPPs operate beyond their domestic market, highlighting the increasingly international nature of open banking in Europe.

This cross-border activity brings both scale and opportunity – but also new challenges. On average, 92% of TPPs active in any given EEA country are regulated by a National Competent Authority (NCA) from another country. This means banks are likely to interact with TPPs whose regulatory oversight sits in another jurisdiction, making it more complex to verify permissions and monitor compliance – unless real-time, pan-European identity and regulatory checking services are in place.

The average number of TPPs per EEA country now stands at 153. Against a backdrop of increased passporting permissions, the risks of relying on outdated or incomplete regulatory information become even more pronounced.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

This quarter’s regulatory activity tells a clear story. The open banking landscape continues to shift, with 31 permission changes across the EEA and UK combined - the highest we've seen in recent quarters. From market exits to mergers and strategic realignments, the pace of change is accelerating.

Within the EEA, we’re seeing signs of both consolidation and expansion. Notably, a growing share of EEA-regulated TPPs are choosing to operate beyond their domestic markets - now 58%, up from 56% last quarter. That’s 208 out of 356 TPPs extending their services across borders, underscoring the region’s continued push for scale and reach.

As organisations expand internationally and reshape their operations, real-time regulatory monitoring remains essential - not just for compliance, but for building and maintaining trust across a fast-evolving ecosystem.Mike Woods, CEO Konsentus