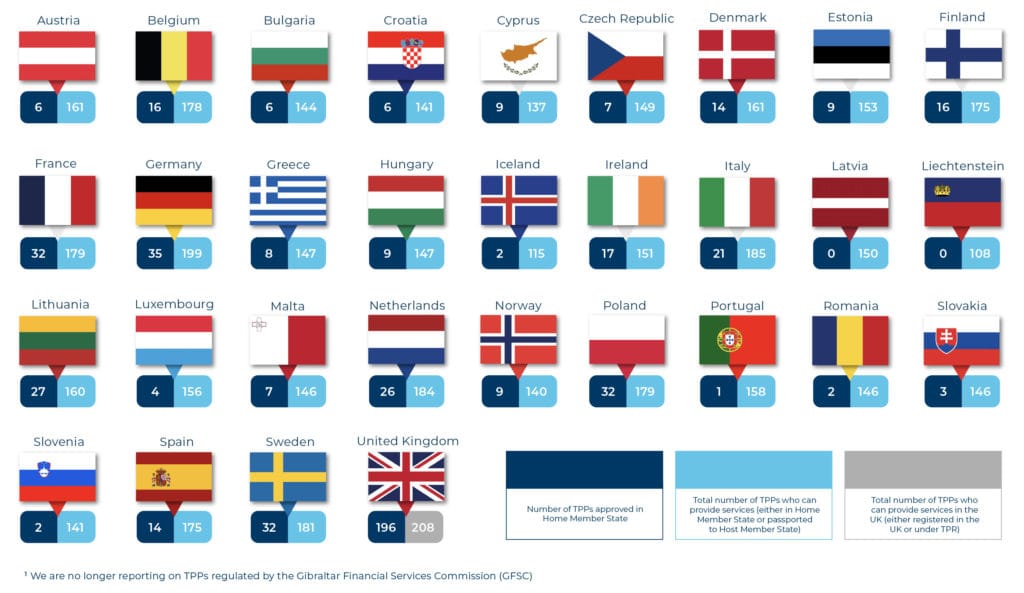

During 2024, the open banking ecosystem continued to transform across the European Economic Area (EEA) and the United Kingdom (UK). The total number of registered Third Party Providers (TPPs) now stands at 568, with 372 in the EEA and 196 in the UK

This quarter marks the first decline in total EEA-regulated TPPs since June 2023, with a net decrease of 4. In contrast, the UK saw a modest increase, gaining 2 TPPs compared to the previous quarter.

Regulatory permission changes remain a key market indicator. In Q4, 20 TPPs underwent permission changes across the EEA and UK combined, with 9 TPPs gaining new open banking regulatory permissions and 11 TPPs either becoming unauthorised or having their open banking permissions removed.

A higher number of TPP removals in the EEA compared to new registrations may indicate a maturing market and emerging consolidation trends. These shifts emphasise the growing importance of thorough due diligence as the open banking landscape continues to evolve.

Q4 Highlights (EEA)

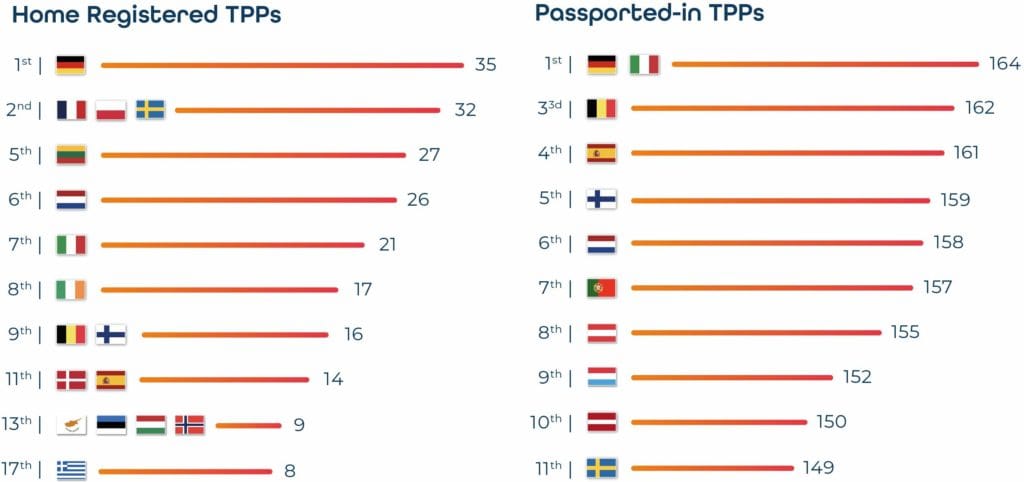

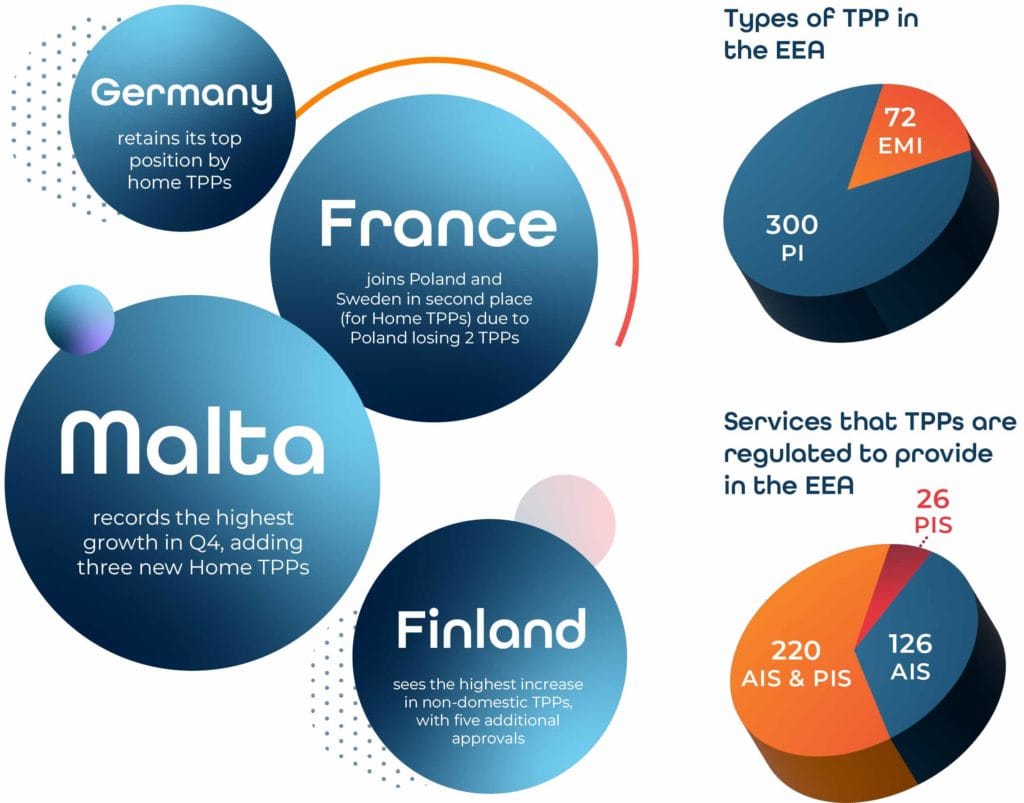

- Despite two TPPs having their permissions removed, Germany retains its position as the top EEA market by home-regulated TPPs (35). Meanwhile, France, Poland, and Sweden remain strong contenders, each with 32 home-regulated TPPs.

- Germany joins Italy in having the highest number of passported-in TPPs (164), following the approval of two additional TPPs to provide open banking services in the country

- Regulatory approvals were granted to a total of five TPPs from three different EEA countries in Q4 2024, comprising Hungary (1), Italy (1) and Malta (3).

- Nine TPPs from six different EEA countries had their open banking permissions removed, affecting Germany (2), Lithuania (1), Norway (1), Poland (2), Spain (2) and Sweden (1).

- Latvia and Liechtenstein once again remain the only two EEA countries without home-regulated TPPs. However, Liechtenstein showed strong performance this quarter, with only Finland surpassing it in non-domestic TPP growth.

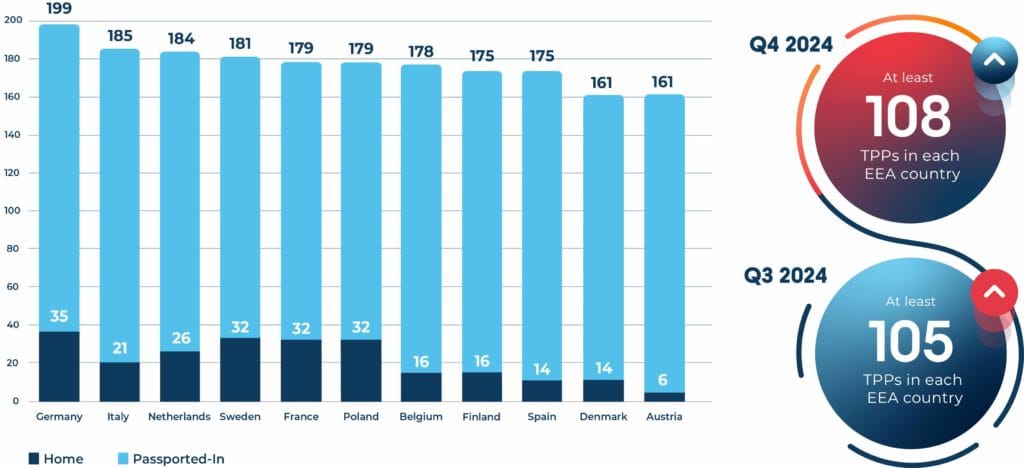

- After a surge in the previous quarter, passporting activity remained steady, indicating a period of market consolidation and stability. As a result, all EEA countries now have at least 108 non-domestic TPPs approved to provide open banking services.

Year on Year Rise in Passported-In TPPs

Average per EEA Country

Top EEA markets by total number of TPPs

TPPs (56%) passport their open banking services outside their domestic market

Average total number of TPPs per EEA country

of TPPs in each EEA market are regulated by an NCA from another country

EEA countries have at least 150 TPPs authorised to provide open banking services

While overall numbers remain consistent with the last quarter, regulatory permission changes continue at a high rate. Each quarter of 2024 has seen at least 20 changes across the EEA and UK combined, highlighting the dynamic nature of the open banking landscape and the necessity of real-time checking services to maintain trust in the ecosystem.

In the EEA a significant milestone has been reached with 17 out of the 30 EEA countries now having over 150 authorised TPPs, more than doubling from just a year ago. This expansion highlights the rapid growth and increasing presence of fintech providers across the region.

Meanwhile, regulatory shifts in the EEA signal market maturity, mirroring patterns previously observed in the UK. This quarter 5 EEA TPPs were approved to provide open banking services whereas 9 became unauthorised or had their permissions removed signalling a stablisation phase as organisations refine their strategic focus. With permissions evolving regularly, continuous monitoring remains essential to staying compliant and capitalising on new opportunities in open banking.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

As open banking adoption deepens, we continue to see significant shifts in how TPPs operate across the EEA. With 66% of EEA-regulated TPPs now able to initiate payments on behalf of account holders, the need for vigilant oversight remains critical to managing associated risks.

At the same time, cross-border expansion remains a key driver of ecosystem growth. More than half of EEA TPPs now passport their open banking services beyond their domestic market. This increases the likelihood that a third-party fintech requesting account access will be regulated in a different market from where the transaction occurs.

Notably, while the number of home TPPs has remained static over the past year, all growth has come from passported TPPs – rising by more than 16% from 134 to 156. This reflects a strategic push by TPPs to scale their businesses internationally, reinforcing the importance of robust, real-time regulatory monitoring to ensure trust and compliance in an evolving financial landscape.Mike Woods, CEO Konsentus