Konsentus launches new ways to access the Konsentus Verify directory

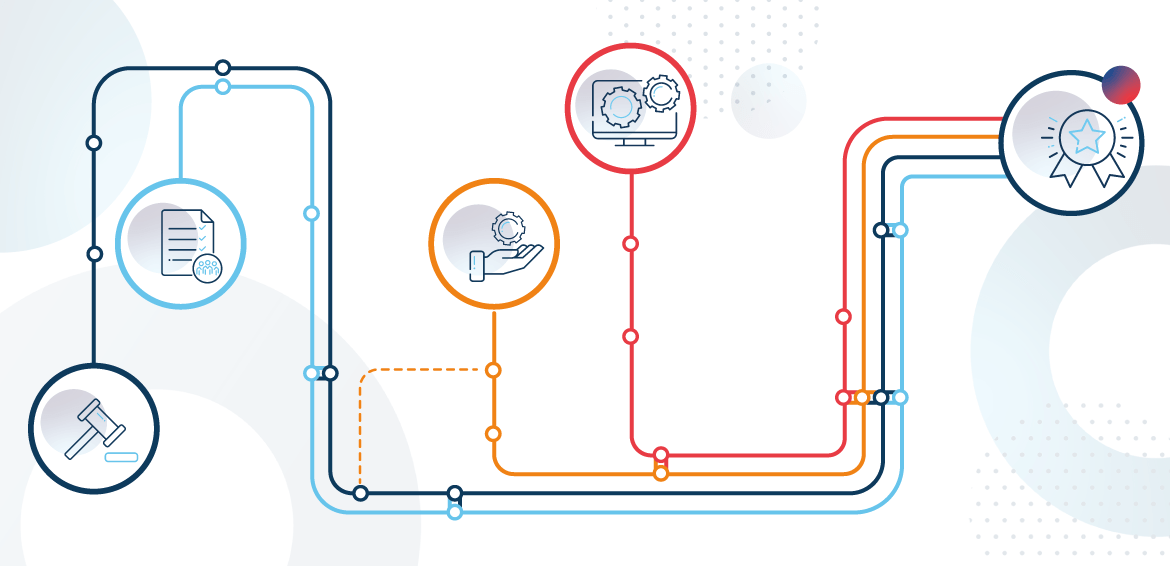

Konsentus’ European trusted data, Konsentus Verify, can now be accessed through an online portal, via a real-time API or a downloadable cache

Konsentus’ European trusted data, Konsentus Verify, can now be accessed through an online portal, via a real-time API or a downloadable cache

In September 2021, former Minister of Finance, Rodrigo Cerda, presented a draft of the ‘Fintech Law’ to Congress. Earlier this month the CMF issued the regulation that would govern the Open Finance System (OFS) in Chile. We take a look at what it’s taken to get to this point and how to make a success of open finance in Chile.

How has the market responded to our guiding principles for open finance in Europe?

Vildan Ali, Data Analyst Kosentus, talks with VP, Head of Marketing, Nicky Valind about the data we collect at Konsentus and how it enables a safe and secure open banking ecosystem.

Finologee is a fast-growing digital platform operator of robust,

ready-made, and compliant systems and APIs for open finance, digital onboarding, KYC lifecycle management, account management, telecom routing, and micropayments.

Paul Love Twelves talks with our VP Head of Marketing, Nicky Valind, about the conversations he’s having with Konsentus clients to help them prepare for the transition to open finance.

Brendan Jones talks to FinMag.fr about Konsentus’ open banking technology and advisory services dedicated to facilitating the adoption of safe and secure open banking and open finance around the world.

In celebration of International Women’s Day 2024, Lauren Jones, our SVP Global Advisory, caught up with Shruti Awasthi, Global Open Banking & Innovation Leader.

As the open banking and open finance market has started to mature, there has been a level of consolidation around key questions as part of any national programme.

This publication focuses on the regulatory-driven markets, all of which have approved competent authorities that authorise and supervise market players.

Protect your customers transacting in open ecosystems.