With the new European Instant Payments Regulation, banks and PSPs across the Eurozone are required to implement Verification of Payee (VoP) by 9 October 2025. Non-Eurozone SEPA countries must comply by July 2027.

The EPC’s VoP scheme provides a standardised framework that helps PSPs validate a payee’s name against the provided account details – essential for fraud prevention and payment accuracy.

What Problem Does VoP Solve?

Without name verification, payers are exposed to:

Misdirected payments

Authorised push payment (APP) fraud

Compliance risks

Banks and PSPs must now support VoP requests and responses for both individuals and businesses with the following information:

Request:

- Name + IBAN

or - IBAN + Payee Identifier

Response:

- No match

- Close Match

- Match

How Can Konsentus Help?

Konsentus offers a fully compliant VoP solution delivered via a cloud-based service providing both Routing and Verification Mechanism (RVM) capabilities.

Whether you need to send or respond to VoP requests, Konsentus provides:

-

Full VoP Requestor and Responder functionality including the matching algorithm

-

Real-time or batch processing

-

A simple integration via an API that merely returns bank account name for a specific IBAN

-

The ability to be fully live and compliant within the EPC timescales

-

Full account verification with match/no match/close match responses

-

Seamless interoperability with other EU PSPs

A Trusted Partner for Seamless VoP Implementation

-

Registered RVM

Fully aligned with EPC scheme rules

-

Rapid Deployment

Go live in weeks with minimal disruption

-

Secure & Scalable

Hosted on AWS EU with 24 x 7 x 365 availability

-

Built for Compliance

Supports EPC FAPI, eIDAS and EDS requirements

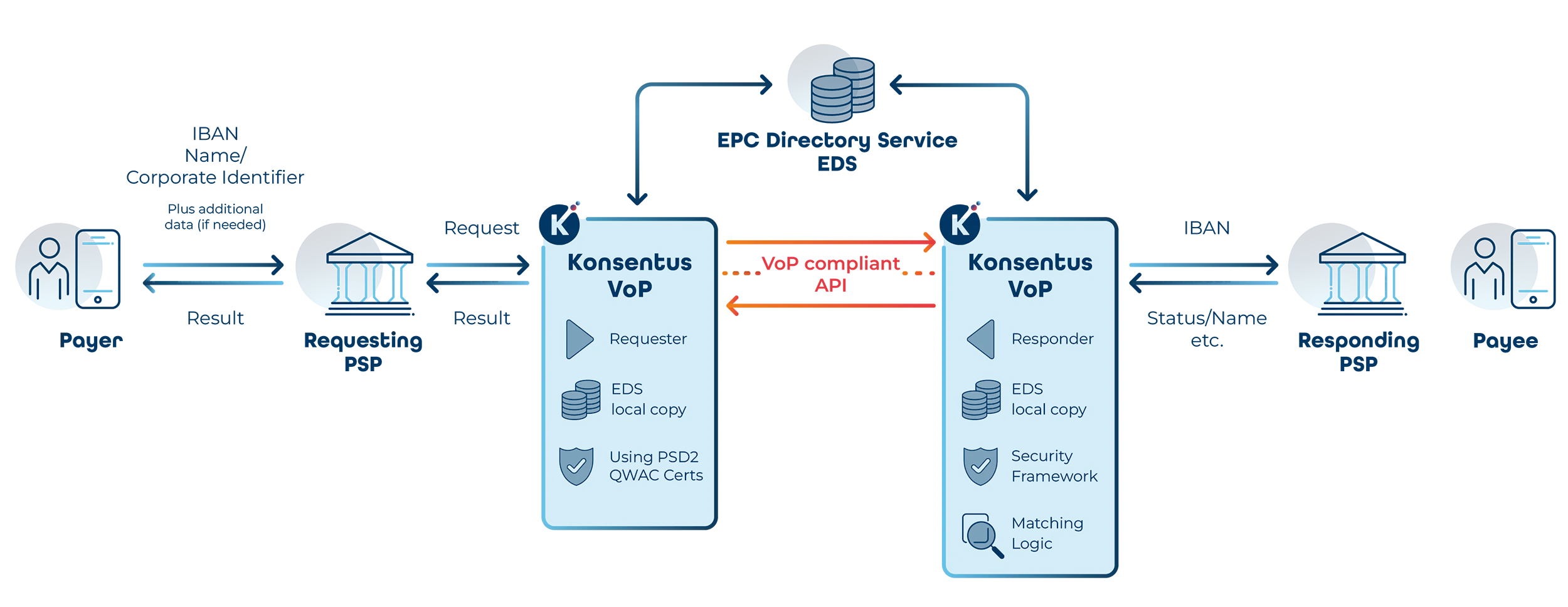

From VoP Request to Match Decision

Seamless & Secure

EPC-Compliant from Day One

Our VoP service includes:

- EPC Directory integration

- Hosted in the EU (AWS, 3 availability zones)

- Full support for API and batch file formats

- Dedicated implementation and onboarding support

- Regular updates in line with EPC rulebook changes

Let’s Get You Ready for VoP

Whether you’re preparing for compliance or scaling your VoP capabilities, Konsentus has the expertise and technology to support you.

Require support for an in-house solution?

The Konsentus Certificate Chain Service for VoP reduces the effort of obtaining and managing certificates for TLS authentication

Konsentus provides all the certificate data needed to automate loading the TLS trust store before processing a payment match request