The First API Based Permission and Consent Management Solution enabling Financial Institutions to meet PSD2 open banking requirements.

Konsentus, a RegTech company was launched today by three payment industry veterans:

Mike Woods: Previously e-commerce executive at Natwest Bank, Founder and CEO of Aconite Technology and CEO of Digital Payments at Proxama PLC.

Brendan Jones: Previously Product Development Director at MBNA and Sales & Marketing Director G&D.

David Parker: CEO of Polymath Consulting Ltd, only payments consultant in European Payments Power 10.

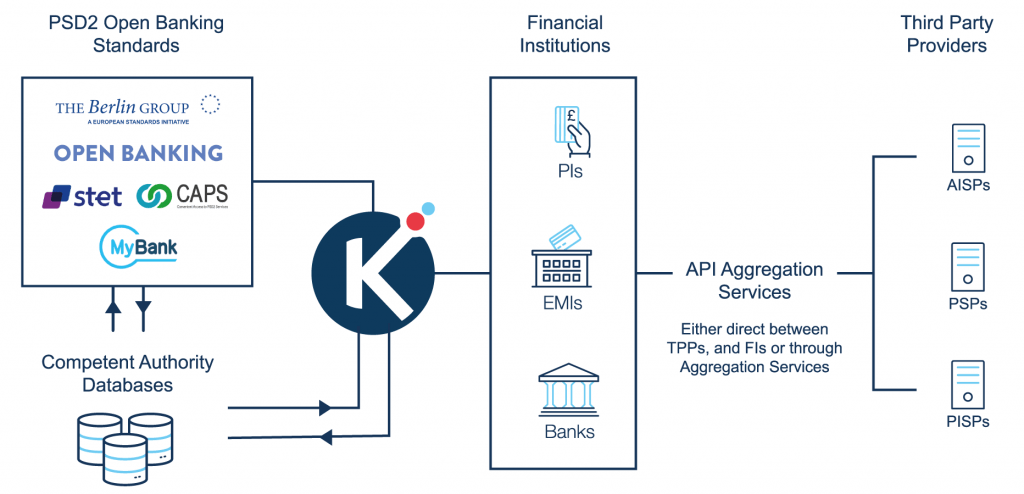

Konsentus is the first company to launch an API based permission and consent management service for Financial Institutions in Europe to enable them comply with PSD2 Open Banking. With some 8,500+ regulated companies offering transaction accounts in Europe the demand for a simple service enabling companies offering their own APIs to ‘Third Party Providers’ to effectively and cheaply be able to outsource the regulatory burden of access of permission management.

“After all my years in the industry it is great to be launching a company that is truly unique in its offering to a market opportunity that in itself is totally new as a result of PSD2. With over 8,500 Banks, Credit Unions, EMIs, PIs all offering transactional accounts that must provide open access APIs we believe the opportunity for a solution like ours to support these organisations, removing their regulatory burden is very significant.”

Mike Woods, CEO and Founder, Konsentus

Konsentus issues the consent management tokens on behalf of financial institutions through a SaaS platform, enabling the FIs to comply with EU regulation and provide open banking services to their customers, confident in the knowledge that they are only providing data to Third Party Providers (TPPs) who are regulated, and have the customers “explicit” consent to use their data.

About Konsentus

Konsentus is a RegTech company that was established to provide consent & preference management services to financial institutions so that they can comply with PSD2 and open banking. Konsentus issue the consent management tokens on behalf of financial institutions through a SaaS platform, enabling them to comply with EU regulation and provide open banking services to their customers, confident in the knowledge that they are only providing data to Third Party Providers (TPPs) who are regulated, and have the customers “explicit” consent to use their data.

The company was founded by three Financial Service industry veterans seeking to deliver a simple and easy way FIs can comply with the new PSD2 regulations for open access.

Headquartered in the UK, just outside of London our team of professionals are creating a world class solution for every FI in Europe. We are delivering this through utilizing the best in open standards, coupled with unique solutions and most of all a belief that we can deliver for clients a cost-effective solution to their regulatory requirements.