How have our market projections been affected by Brexit?

Since we published ‘Open Banking API calls – what lies ahead’ in June 2020, there has been a dramatic change in the market. Nearly half of all regulated TPPs, those registered with the UK’s FCA, no longer have the right to passport their services into the EEA. So how does this impact the data we published last year and what transaction volumes are we now predicting based on the post Brexit landscape?

Before we walk through the methodology used, it is worth drawing attention to the dramatic increase in API volumes seen in the UK over the past two years as the UK curve forms the basis for our EEA market predictions.

In January 2019, the UK’s top nine banks were seeing a total of 23.1m monthly API calls equating to 0.7m calls a day. Only a year later that figure had increased to 321.3m per month – nearly 14 times higher than the previous year. This dramatic increase provides some of the context for the growth we are predicting across the EEA by the end of 2022.

Methodology

- All projections are based on a combination of the UK API calls (AISP) as published by OBIE and the Konsentus TPP tracker data.

- The API call volume provided by OBIE is increased by 25% to include non-CMA9 participants and PISP transactions. This sets a UK API trend line.

- The total native and passported-in TPPs for each EEA country as of January 2021 is cross referenced with the relative position on the UK API trend line. This determines the start point for each country with volumes extrapolated based on the UK curve.

- API volumes are adjusted in accordance with the population in each country.

- The underlying growth rate of 5% is assumed for the projections.

Key Findings

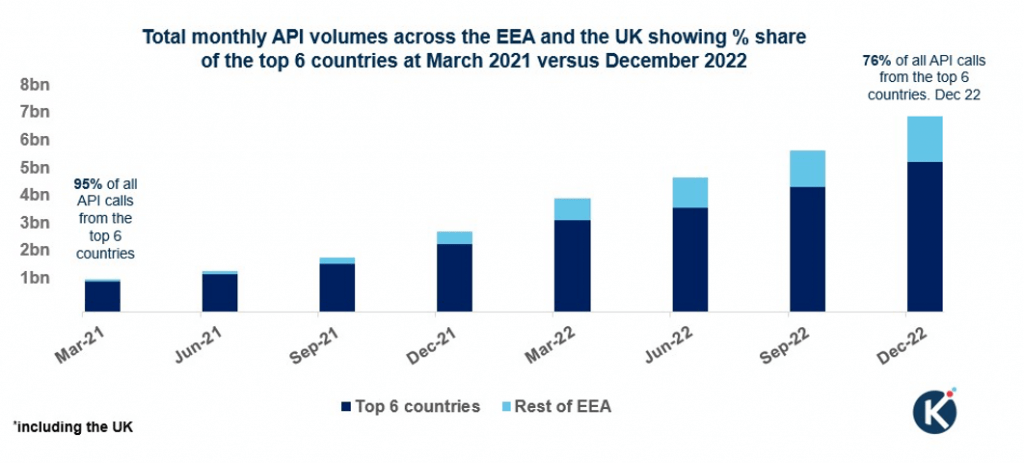

- In March 2021, the top 6 countries made up 95% of the total volume. By December 2022, this figure is reduced to 76% showing that more countries are embracing open banking.

- By December 2021, the total number of monthly API calls across the EEA and UK is expected to reach 2.9bn with the UK, Germany, France Italy, Spain, and Poland all experiencing over 150m API calls per month.

- By December 2022, 13 countries will be seeing more than 100m API calls per month. The UK, Germany, Spain, France, and Italy will all be experiencing over 500m API calls per month.

- By December 2022, the total number of monthly API calls across the EEA and UK is expected to reach 7.1bn

- The UK is expected to hit 1bn API calls per month by May 2021.

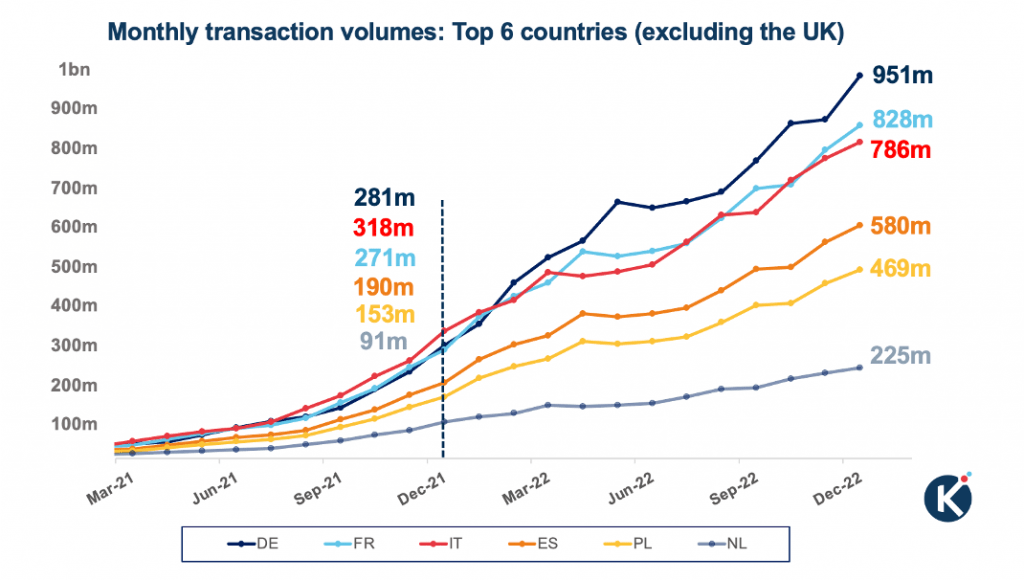

Although it is true to say that the UK is approximately 18 months ahead of the EEA, other countries are also experiencing significant volumes. Our data suggests that Italy, Germany, France, and Spain are all today seeing excess of 20m monthly API calls. By the end of 2022, Germany, France Italy, Spain, Poland, and the Netherlands will have monthly transaction volumes over 200m as shown on the graph below.

March 2021

December 2022

Summary

Open banking has grown at a phenomenal rate over the past 12 months – in part this has been driven by the shift to digital products and services resulting from the global pandemic. Anecdotal evidence from across the EEA supports our above findings with many organisations from different EEA countries confirming monthly volumes running into millions.

This clearly shows that there is strong demand for the wide range of products and services that are already being seen in the market – ranging from account aggregation and confirmation of funds to automated spending, accounting services and loyalty programmes. What is also evident from our data is that cross border transactions are now the norm rather than the exception.

With increasing numbers of TPPs seizing the opportunity to capitalise on the open banking journey, we are sure our estimated volumes can only rise.