Halfway through the year, we can report an upward trajectory for the overall number of TPPs providing open banking services within the EEA. In the UK, the effects of a more mature market and changing business models have resulted in several TPPs losing their PSD2 regulatory permissions, reducing the UK’s total.

In the EEA, apart from a slight dip in June 2023, there has been consistent growth over the last six quarters. Since the end of March of this year, 8 TPPs have gained regulatory approval and 5 TPPs have had their permissions removed, resulting in a total of 370.

However, the story is different in the UK. Only 1 TPP became regulated to provide open banking services whilst 9 others lost their regulatory permissions, so the UK’s overall total is now 197 – the first time it has fallen under 200 since November 2020!

The figure for the EEA and UK combined now stands at 567. Although this is lower than we reported at the end of Q1 2024, the 23 permission changes over the last quarter are consistent with the first three months of the year.

The data reveals that once again the market is dynamic making it important to check data access requests both from TPP fintechs but also credit institutions to ensure consumer and business data is always safeguarded.

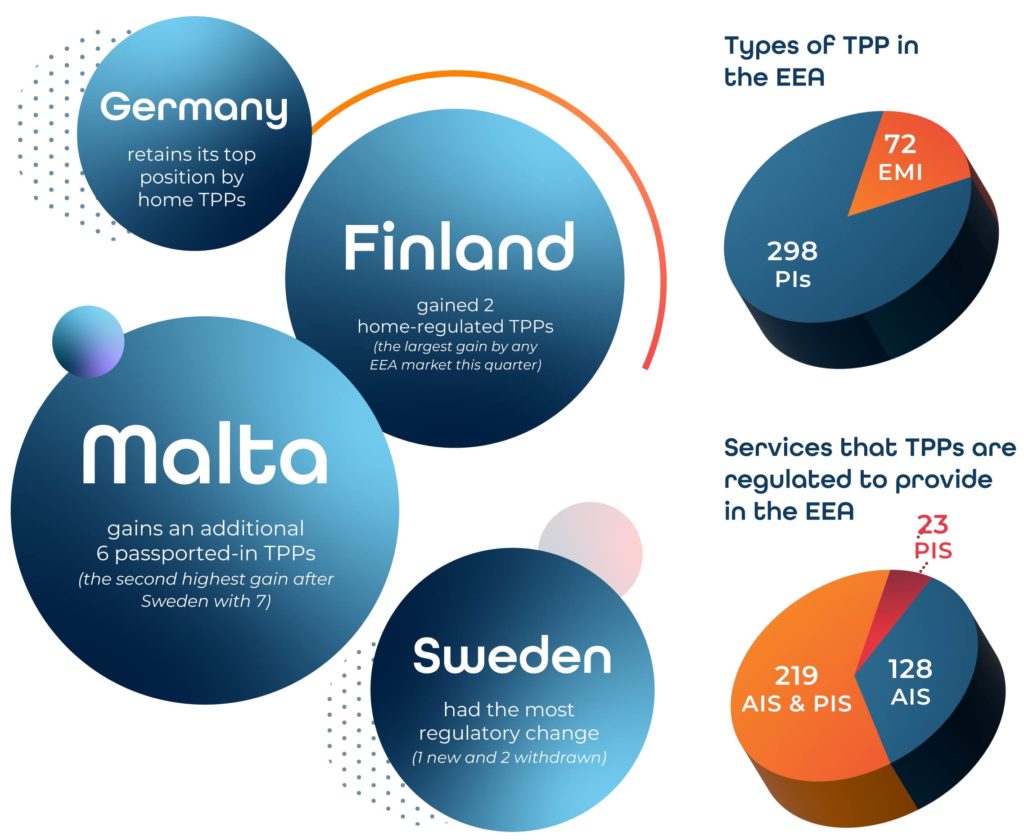

Q2 Highlights (EEA)

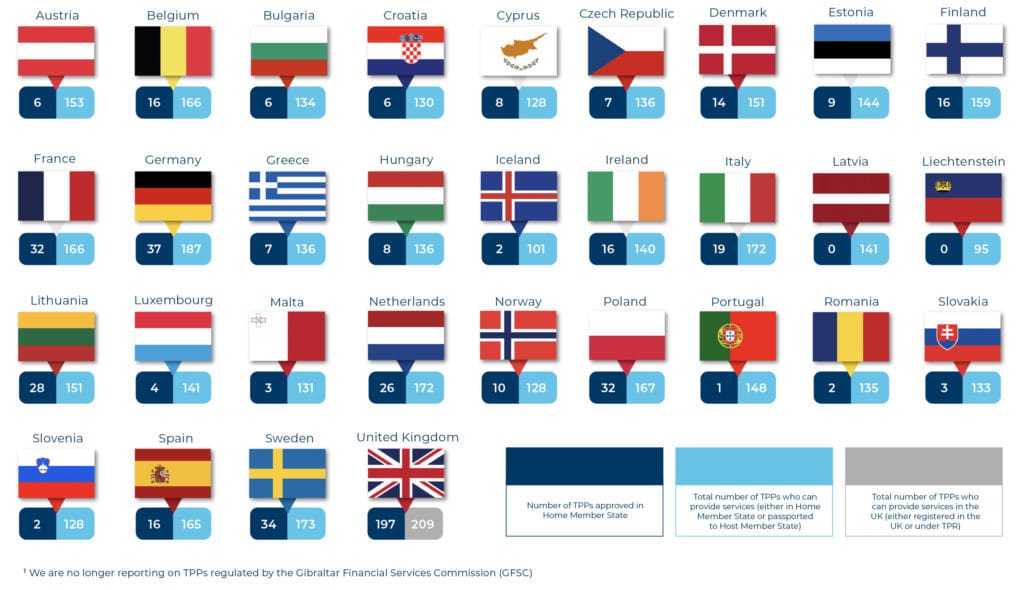

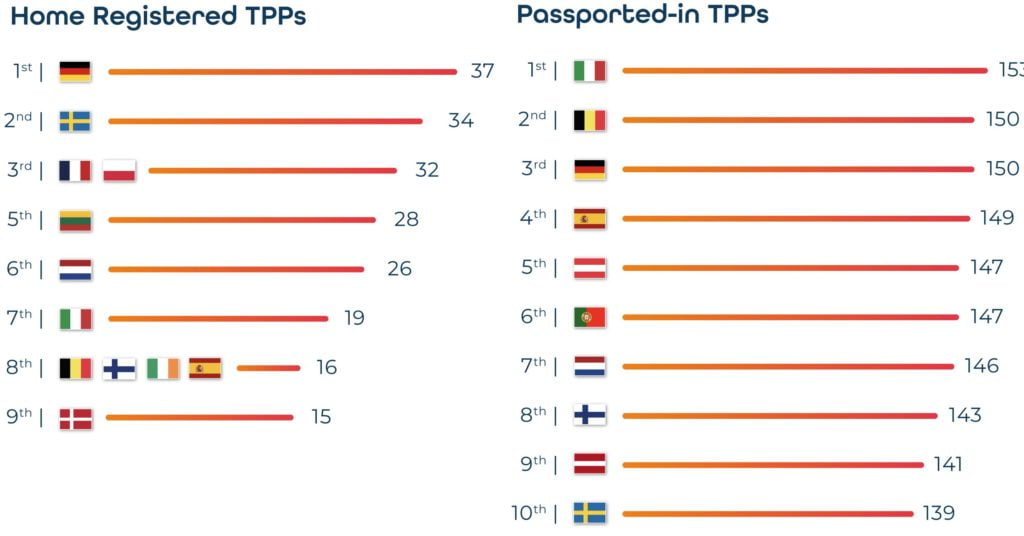

- Germany retains the top position by highest number of home-regulated TPPs at 37, increasing its lead over Sweden in second place.

- Italy still has the highest number of non-domestic TPPs, with 153, followed by Belgium and Germany with 150 respectively.

- TPPs from 7 different EEA markets gained regulatory approval during the second quarter of 2024: Belgium (1), Croatia (1) , Finland (2), Norway (1), Spain (1), Sweden (1) and Ireland (1).

- TPPs from 4 different EEA countries had their permissions removed: Estonia (1), the Netherlands (1), Spain (1) and Sweden (2).

- Latvia and Liechtenstein once again remain the only two markets with no home TPPs.

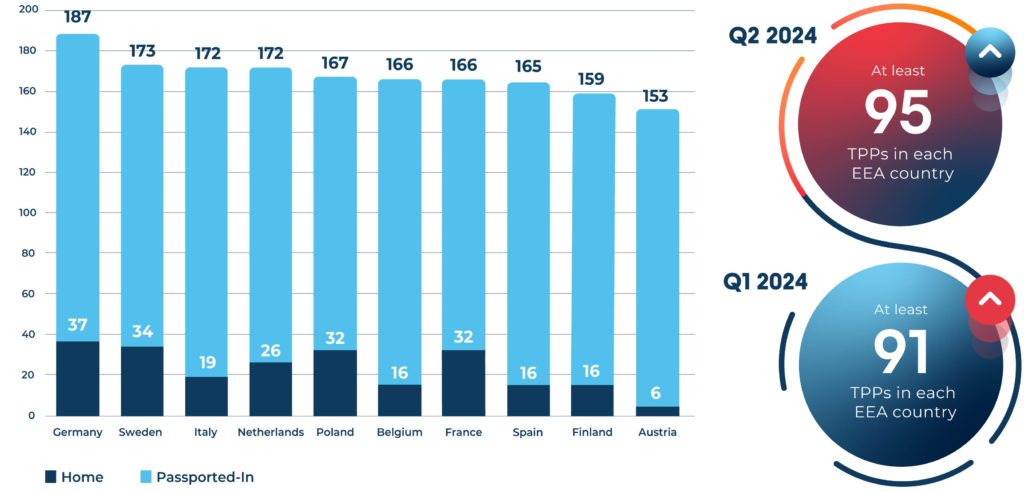

- Passporting once again remains strong, with the average number of non-domestic TPPs per market increasing by 12% over the last nine months.

Year on Year Rise in Passported-In TPPs

Average per EEA Country

Top 10 EEA markets by total number of TPPs

TPPs passport their domestic open banking services to other countries within the EEA

Average total number of TPPs per EEA country

Of TPPs per EEA market, on average, are regulated by a competent authority from a different country

Average net increase in non-domestic TPPs per EEA country

(Dep 23 – Jun 24)

There are now more than 100 TPPs regulated to provide consumers and businesses with open banking services in all EEA markets, apart from Liechenstein. This means that, even in markets where there is limited supply from domestically regulated TPPs, there are plenty of fintechs to satisfy consumer demand with access to innovative products and services.

Although the growth in newly regulated TPPs is not as marked as it was when

the regulation first came into force in the

EEA in 2019, the trend for companies to grow their businesses by extending services into new territories looks set to continue.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

After nearly five years of PSD2 open banking implementation in the EEA, we can easily see emerging trends and how the landscape is evolving.

In September 2019, only 48% of EEA TPPs could initiate payments on an account holder’s behalf. That figure has now surpassed 65%.

There has also been an increase in international fintechs honing their product benefits to appeal to consumers across multiple markets which is why we see this quarter-by-quarter growth in passporting, with over 53% of EEA TPPs now providing open banking services outside their home nation.

I’m sure these two trends are set to continue as open banking in Europe matures, giving rise to the importance of ensuring the deployment of robust risk management tools to prevent consumer and business data mismanagement.Mike Woods, CEO Konsentus